An array of investment strategies

An array of investment strategies

Our Beliefs

- Buy & Hold DOES NOT work

- Stocks/markets/assets go through bullish (rising) periods, which are followed by bearish (falling) periods – extract profits regularly

- Holding equities in a bear market/downtrend is akin to financial suicide

- Small losses are preferred to big losses

- ANYTHING is possible

Our Methods

Trend Following

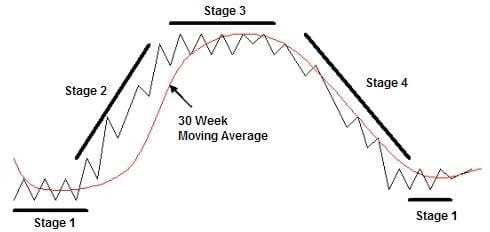

In the world of finance, there exists an investment strategy that has stood the test of time – trend following. This systematic approach aims to capitalize on price trends in various markets, be it stocks, bonds, commodities, or currencies. The beauty of trend following lies in its simplicity; it doesn’t rely on understanding why a market is trending, but instead focuses on profiting from the trend itself.

Source: Stan Weinstein

The performance of trend following during turbulent times further highlights its potential. It has shown positive long-term returns and profitability during periods like the Global Financial Crisis (’07-’08) and the Dotcom Bubble Burst (’00-’02). This ability to perform well even in challenging economic conditions makes trend following an attractive option for those seeking stability in their investment portfolios.

Source: Optuma

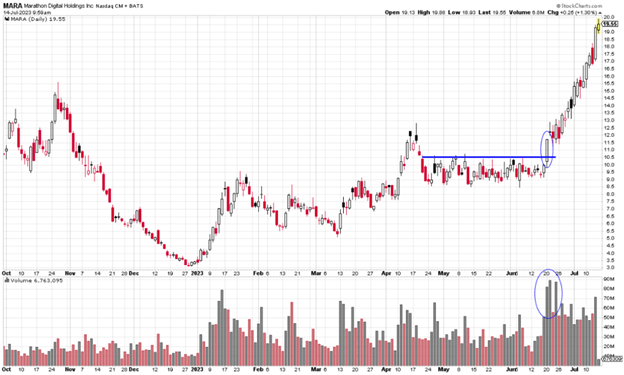

Breakouts

Breakout investing is a strategy centered around identifying key moments when a stock, commodity, or any other financial instrument breaks through a significant level of support or resistance. Support refers to a price level where the asset has historically tended to stop falling, while resistance represents a level where the asset has struggled to move past.

When a breakout occurs, especially on significant volume, it indicates a potential shift in the market's sentiment and momentum. Demand suddenly overwhelms supply (or vice versa). These breakouts can lead to substantial price movements, creating an opportunity to profit from the surge in either the upward or downward direction, depending on the breakout type.

Source: Stockcharts

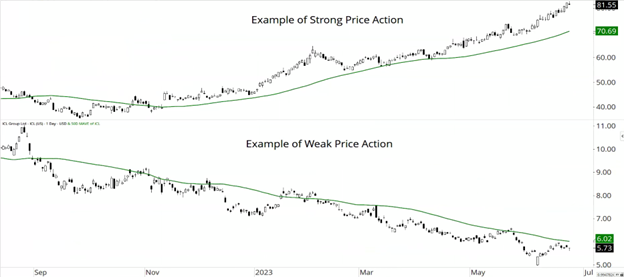

Relative Strength

At its core, relative strength compares the performance of one investment asset against another or against an index. It provides valuable insights into the strength and/or weakness of different assets, sectors, or even entire markets. The key to understanding relative strength lies in comparing the price movements of assets over a specific period, often using technical analysis.

The primary objective of employing relative strength is to identify assets that are outperforming an alternative investment. Investors seek these assets as they could be potential winners with higher growth prospects and potentially less downside risk. This relative outperformance indicates that the asset is gaining strength compared to others, hence the name "relative strength."

One popular way to use relative strength is by constructing a relative strength chart. By plotting the price of one asset against another, investors can visually assess which one is performing more strongly – i.e., is investment A better than investment B? This helps investors identify trends and make more informed decisions when selecting investments for their portfolios.

Source: Optuma

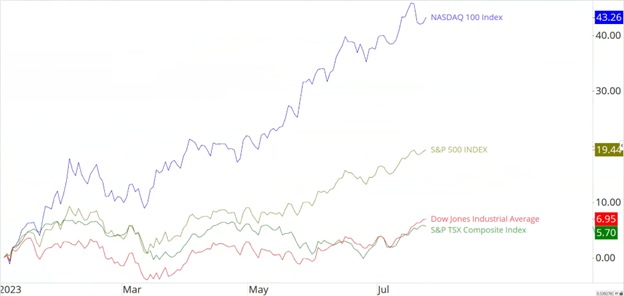

Momentum

In the fast-paced world of investing, seasoned investors and financial analysts often speak of a mysterious force that can propel stocks to new heights and create lucrative opportunities. This phenomenon is known as momentum, and it plays a significant role in shaping the trajectory of investments. Understanding momentum is crucial for investors seeking to make informed decisions and harness the potential for substantial returns.

In physics, momentum refers to the force that keeps an object in motion. Newton’s Law states that an object in motion stays in motion, unless acted on by an unbalanced force. Similarly, in the financial realm, momentum in investing describes the tendency of an asset's price to persist in the same direction over time. Put simply, assets that have performed well in the recent past are likely to continue performing well, while those that have underperformed tend to keep struggling.

Source: Optuma

These are just a few of the tools in our investor toolkit, and none of them are used in isolation. Market conditions, fundamental analysis and many other indicators all play an important role when making decisions with our capital.

-

We are committed to offering you access to a wealth of high-quality investment opportunities. Using our extensive experience with the various choices for your portfolio, we can help guide you toward investments that are the right fit for your circumstances.

Our offerings include:

- Actively Managed Discretionary Accounts

- Equities

- Exchange-traded funds (ETFs)

- Fixed income

- Alternative investments

-

We use a data-driven investment process that combines advanced analytics and cutting-edge technology to make smarter decisions for our clients. Our transparent and well-defined process keeps our clients informed and involved, every step of the way.

-

We employ a personalized process to build a customized, diversified portfolio that addresses your objectives. This process begins with focusing on what’s most important to you as we build a lasting relationship based on understanding and trust. Our team then designs and actively manages your financial plan, adjusting along the way to meet your changing needs.

-

Our process combines a blend of both fundamental and technical disciplines. Sometimes, investors don't have a rationale for why they buy a stock and even more fail to have an exit plan in place before taking a new position. Exits and/or a sell plan are far more important than the buy decision since it's the exit that determines whether you make money or lose money! Our process is quite comprehensive, and can be better understood by reading our Investment Philosophy. Click here to view Our Investment Philosophy.

-

In a market environment where Financials and Natural Resources have become leadership groups, how do we not have a conversation about Canada? Taking that one step further, we need to talk about how any investor, whether living in Canada or not, can take advantage of a potential structural swing in the trend for Canadian Equities. Click Here to listen!

-

Click here to view the Tale of Six Investors.

Enhance your corporate giving strategy with a donor advised fund

Is your business a solo show? Learn about owner-only 401(k) plans

Why 15 minutes of mentorship has game-changing potential

- Financially INsync 595 Parkside Drive, Unit 1 Waterloo, ON N2L 0C7

- T 519.883.6062

- F 519.883.6079

- Map & Directions

- Map & Directions

© 2026 Raymond James Ltd. All rights reserved.

Privacy | Advisor Website Disclaimers | Manage Cookie Preferences

Raymond James Ltd. is an indirect wholly-owned subsidiary of Raymond James Financial, Inc., regulated by the Canadian Investment Regulatory Organization (CIRO) and is a member of the Canadian Investor Protection Fund.

Securities-related products and services are offered through Raymond James Ltd.

Insurance products and services are offered through Raymond James Financial Planning Ltd, which is not a member of the Canadian Investor Protection Fund.

Raymond James Ltd.’s trust services are offered by Solus Trust Company (“STC”). STC is an affiliate of Raymond James Ltd. and offers trust services across Canada. STC is not regulated by CIRO and is not a Member of the Canadian Investor Protection Fund.

Raymond James advisors are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. Statistics and factual data and other information are from sources RJL believes to be reliable, but their accuracy cannot be guaranteed.

Use of the Raymond James Ltd. website is governed by the Web Use Agreement | Client Concerns.

Raymond James (USA) Ltd., member FINRA/SIPC. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions in which they are properly registered. | RJLU Legal

Please click on the link below to stay connected via email.

*You can withdraw your consent at any time by unsubscribing to our emails.

© 2022 Raymond James Ltd. All rights reserved. Member IIROC / CIPF | Privacy Policy | Web Use Agreement