Monthly INsync Chit Chat April 2025

Politicians and our Government… [by David Cox]

I took my two youngest kids (Emry and Eloise) to the Waterloo Rec Swimplex this past month and we were excited to try out the waterslide (fully enclosed tube) we saw from outside. But inside, we were disappointed to find out that the waterslide was closed, as the “government” had decided that waterslides presented too much danger to kids. Then, we went to the other end of the big pool to the hot pool/tub and were further told that that area wasn’t open either, as the heat could be too dangerous for us. Emry and I used the high diving boards (I was pretty excited to see a 3m platform too!) but you guessed it, the platform was off limits and only accessible to those on the current diving team (so much for my past diving experience). I think we’re creating a society of weak kids who are afraid of the world around them, but perhaps you think I’m just a naïve dad and it’s all for the better.

Approximately 12-13 years ago, I was at a luncheon (along with 250 or so other guests) hosted by the KW Chamber of Commerce and Mark Carney (then governor of the Bank of Canada and now Prime Minister of Canada) was the guest. I stepped up to the mic and asked him if he thought the basket of goods used to calculate and measure inflation seemed legitimate and a fair representation of the actual and underlying costs experienced by the average Canadian. I remember thinking his answer was weak, canned and thoroughly disappointing (he said they’d done many studies and thought it remained fair) but then again, he had a role and an image to uphold. Now, despite whatever his personal investment and business interests may be, he has a new role as the unelected Prime Minister to uphold.

News – Some That You’ve Heard, Most That You Haven’t - [by David Cox]

U.S. stocks swoon as Trump sows economic fear across Wall street. British Columbia bans American liquor from Republican states and then expands the ban to include all of the U.S.A. (last I checked Instagram/Facebook/Amazon/Netflix all still permitted). City of Toronto employees are banned from using Amazon and Uber (surprised more voices don’t see this as a form of control similar to those COVID days). Mark Carney refuses to answer the simple question posed by The Globe & Mail about what types of investments he had the day before they were pushed into a blind trust. Carney vows to revive Canada’s wartime-era homebuilding strategy. Royal Bank of Canada (and others?) are now providing blanket appraisals in the Toronto condo market up to 115% of appraised value for pre-construction funding so the projects don’t default. Unsold real estate inventory in Toronto is at 2008 levels.

What Are We Buying? Selling? Holding… [by David Cox]

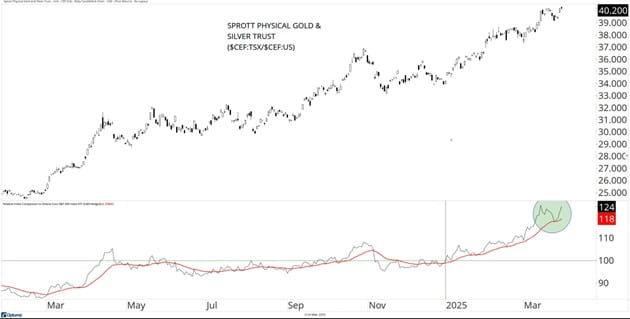

Last month, I mentioned silver and, given the market circumstances (March 2025 has been the weakest March since 2022, which was not a good year!), I’ll again point out that we’ve been adding to our position in gold and silver bullion via the short-term dips that have occurred with the Sprott Physical Gold & Silver Trust, a dual-listed ETF (and the old Central Fund of Canada). Gold is performing admirably and acting as the safe haven reputation it has. I think it’s also benefitting from the increasing and perceived risk of the fiat currency system and I can only wonder if the upcoming (hopefully!) audits of Fort Knox will prove the stated U.S. reserves are what they say they are. As a funny aside, Canada doesn’t claim to have any gold; in fact, I believe it factually has none, despite the strengthening nations of the world increasing their stockpiles. #oops.

Source: Optuma

* as at March 28th, 2025

AllINsync: How Are We Exposed? [by David Cox]

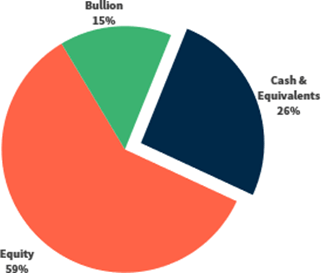

I’d be lying if I said there was anything easy about the recent market. Uncertainty and volatilty have been the order of the day. How are we positioned? Our “AllINsync” pool is a 100% equity oriented growth pool with a benchmark of 50% S&P/TSX Composite (Canadian stocks) and 50% S&P 500 (U.S. stocks). But we certainly manage risk and tactically adjust, depending on the changing environment.

Here's our current overall asset allocation “AllINsync” and you can see that we only have 59% equity at this stage, with cash and gold/silver bullion making up ~41% of our overall exposure.

Source: Croesus

* as at March 28th, 2025

Artificial Intelligence -> Human Wisdom? [by David Cox]

What did I use ChatGPT for this month? Well, Eloise (10) and I both won Solitaire (playing separately) at the exact same time on the weekend(!!). I know, crazy right? I told her I hadn’t won in so many years that I couldn’t even remember, and she told me she didn’t think she’d ever won (both of us were questioning the odds), so we asked ChatGPT.

Excuse me for perhaps appearing old school, but “undo?” That sounds like cheating to me (lol) – but whatever. Eloise and I learned that 10-15% is our expected win rate and it’s fun teaching her what that means in terms of how many games we should have to play to win.

How’s the (Bigger Picture) Market? [by David Cox]

Allow me to be objective (as I always strive to be!) as we look at this weekly chart of the U.S. stock market. In the green circle, we are testing (but finished below last week) that horizontal line marking the summer ’24 highs, having already given up the election breakout line earlier in March. We are oversold (bottom panel) for the first time since 2023 (oversold does not mean guaranteed higher markets to come!), but it does mean a lot of selling has taken place and that means the risk of getting whipsawed by selling copious amounts of equity exposure at these levels is quite high. We’re still sitting above a rising 65-week exponential moving average (green line) and this is one of the ways I gauge long-term trend (the other is by comparing the 13/34-week moving averages, which are still positioned bullishly, though without upside improvement in April, we’re likely to see them cross before too long).

Source: Optuma

* as at March 28th, 2025

Lifestyles to Consider! [by Criselle Tung]

As we approach a new quarter, it's a great time to reflect on our progress with annual resolutions. After indulging during the holidays, it's common to see "Workout more" on our list of goals. However, a holistic approach to wellness, encompassing physical, mental, and spiritual well- being, is gaining traction. Let's discuss!

While working out is a popular way to stay physically active, yoga and meditation, despite their slower pace, offer a multitude of benefits. (Don't be fooled by their gentle nature!) Yoga provides a blend of physical exercise and mental relaxation. It can be done anywhere—on a mat in a studio, by the lake, in a park, or at home. Just open a video on YouTube (I love Boho Beautiful Yoga!), and you're good to go. This convenient practice not only strengthens the body but also calms the mind, setting a positive tone for the day ahead.

Meditation cultivates mindfulness and reduces stress, promoting mental clarity and emotional stability. Like yoga, meditation can be done anywhere. Find a quiet space, whether it's your bedroom or a meeting room at the office, close your eyes, imagine yourself in a serene place or open a meditation app (I highly recommend Headspace), and focus on your breath. This powerful practice can make a huge difference, even with just a 5-minute session.

Turning down the noise around us and finding a quiet place for these practices can be challenging. But believe me—once we become more intentional and start integrating a few minutes of yoga and meditation into our daily lives, the results will be phenomenal.

Market Summary and Trend of “All Assets” - [by David Cox]

Copper, silver, gold and European stocks are sitting atop the 2025 YTD % change leaderboard at this stage, as we finish the first quarter of the year. We still have mostly long-term uptrends in place (see green in the column below) but the markets have been quite weak in the U.S. and even more so in growthy areas (Vanguard Growth $VUG -9.8%). As I alluded to above, I still think we have to be a little careful with assuming European stocks are the place to be and before we re- allocate to 100% non-U.S. equities. With so much change and volatility having occurred, it’s perhaps also a useful reminder that relative strength is one thing but absolute trend is another. Anyways, I don’t want my expectations to get in the way of the data that exists, so let’s leave it there.

Source: Optuma

* as at March 28th, 2025

Sharing Our Tools of the Trade - [by David Cox]

For some time, I have used my own prioprietary measure to estimate the amount of perceived risk of a given security or position in a portfolio that incorporates the average true range (ATR). More specifically, I use the ATR over 20 periods and I divide that by the moving average of price, over the same 20 periods. Essentially, it becomes a proxy for expected % change and I recently decided to validate my approach. I compared a number of data sets against the more classic annualized standard deviation measure and found a strong positive correlation.

The amount of risk inherent in a portfolio depends on how it’s constructed, and this topic has not only interested me, but is frankly incredibly important. It’s easy to buy stocks, but using them in a quantity that exposes us to an expected amount of risk seems like a good desire, and, so we must use techniques to understand how much risk we have in a portfolio. By multiplying the % weighting of a security (position size) in our #AllINsync pool, by the ATR(20)/MA(price,20) we can understand our exposure. Exchange Traded Funds (ETFs) tend to have less risk per position, if only because they are more diversified and so right now, here’s how we sit.

13 stocks – total weighted risk: 0.84%

8 ETFs – total weighted risk: 0.5%

Gold/Silver bullion – total weighted risk: 0.16%

If we add up these components, we sit with ~1.5% volatility exposure and we can compare that to the S&P 500 which is 2.87%. Putting them together implies (1.5/2.87) = 52.3% relative risk at this stage through the close of last week. So although our portfolio is ~59.5% equity, we have only 52.3% of the risk of the stock market (that implies that our equity on the whole, is less risky than the market). Remember, these are estimates of volatility using actual price data (no forecasting).

One UPtrend, One DOWNtrend - [by David Cox]

With so many more stocks falling this month than rising, let’s show two falling (and weak) stocks that one could postulate are weak because of the perceived risk of tariffs on their businesses and/or the Canadian economy in general. Without thinking too hard, it’s auto parts that tend to come to mind as we evaluate the possible areas of trouble caused by new tariffs and/or a slowing economy. The auto industry isn’t an easy one to navigate at the best of times, and the suppliers of parts are subject not only to the demand from those big auto manufacturers, but also possible competive changes depending on levies put on their product. Magna is -61.4% from its recent highs, but you can see that it’s actually been weak for the past few years, and so, I think it’s unfair to blame Trump/tariffs or econmomic forecasts on their troubles. TFI International on the other hand, which provides transportation logistics, has fallen -50.1% in short order this year and might be a casualty, as investors reposition and adjust expectations.

My take, of course, is that these are both downtrends and so, not our problem (our clients don’t invest in stocks trending downwards). Let’s instead use these charts as a reminder that there are always narratives, media opinion and analysts trying to tell us the why, but ultimately stocks fall under the weight of increased selling pressure and rise with increased buying pressure.

Source: Optuma

* as at March 28th, 2025

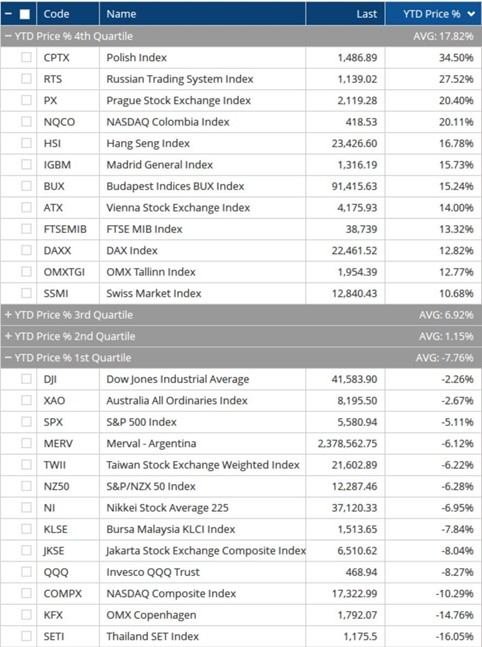

Chart of the Month - [by David Cox]

The markets have shifted gears considerably in the past few months. While the U.S. stock markets have led the way globally since the fall ’22 bottom, you can see the dramatically altered landscape in the table below. I do remind you though that this is only a few months’ worth of price action, but it’s the foreign markets in that top quartile and the S&P 500 and Nasdaq 100 in the last (4th) quartile below and down for the year (the Toronto stock market has improved considerably (not shown) but sits in the third quartile).

Is the Europe rally for real? These are the questions we need to ask ourselves as we’ve been investing in a U.S.-centric, relative strength environment for many years. Based on everything I look at, I think it’s premature to give up on the U.S. just yet. But you know me, when the price information tells us otherwise, I’ll be the first to speak up about it!

Source: Optuma

* as at March 28th, 2025

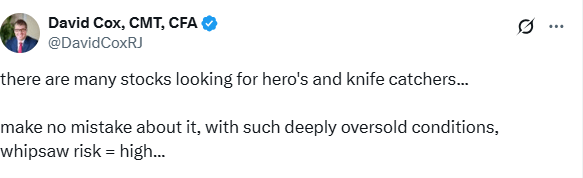

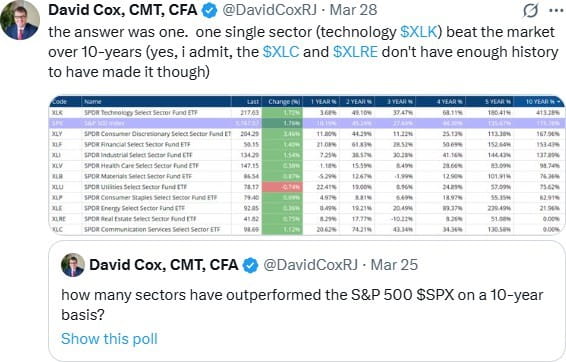

Social Media and Our Website - [by David Cox]

No matter what conditions we’re faced with in the stock market, I tend to keep a steady flow of posts on “X” as I share what I see. Here’s a couple of recent posts in case you didn’t see them.

Upcoming Dates, Seminars, and Announcements - [by David Cox]

What: “Nomad Capitalist Live”

Where: Kuala Lumpur, Malaysia

When: September 17-20th, 2025

Who: I’m going again!

What: “CMT Global Summit”

Where: Dubai, UAE

When: October 1-3rd, 2025

Who: Yours truly will make a second trip to this exciting part of the world!

Thanks for taking the time to read our “Monthly INsync Chit Chat” and a reminder that I always appreciate your feedback! Thanks in advance!

Sincerely,

David Cox, CFA, CMT, FMA, FCSI, BMath

Senior Portfolio Manager, Wealth Advisor

Raymond James Ltd.

Phone: 519.883.6031

Unit 1 – 595 Parkside Drive I Waterloo, ON I N2L 0C7

www.financiallyinsync.com

![]() @DavidCoxRJ

@DavidCoxRJ

Disclaimer: Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Financially INsync Team, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Statistics, factual data and other information are from sources believed to be reliable but accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James Ltd. is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities.

Raymond James Ltd. is a Member Canadian Investor Protection Fund.

Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd., member FINRA/SIPC.