Monthly INsync Chit Chat May 2025

Scooting Around Tariffs… [by David Cox]

After seeing orange (Neuron) scooters all around Waterloo, Eloise, Emry and I decided it was finally time to hop on them for a ride. And fun they were! Download the app, scan the scooter code and zoom, zoom, off we go! They are controlled with maximum speeds via a governor and even talk to you, as speed zones change via GPS, nearing intersections (we went from Waterloo Park down to Kitchener on the Iron Horse Trail), and logged 7.5km (you pay by the minute!).

I was at a dinner party recently and it only confirmed my suspicions. When I arrived, the topic was Trump and tariffs (how boring by now!?), and it quickly became obvious to me that most Canadians don’t even know that the so-called “Trump Tariffs” aren’t added to the cost of goods we purchase (it’s our own Canadian government putting tariffs on stuff we buy). I was happy to jump into the conversation and immediately brought up the Chinese complaint to the WTO about unfair Canadian tariffs put on EV cars, critical minerals, batteries and the list goes on. No one even seemed to realize that Canada is under investigation for these unfair practices. Be careful pointing fingers and being led by the media, who might lead you down the path of hypocrisy. I also find it almost absurdly laughable at the idea of seeing Costco (in Canada) remove U.S. wine from shelves (like the liquor stores), as shoppers demand all Canadian content [Costco is a U.S. corporation that they’re shopping at - #oops].

News – Some That You’ve Heard, Most That You Haven’t - [by David Cox]

Mark Carney wins the Canadian federal election and becomes the new Prime Minister. Pierre Poilievre, the Conservative Leader loses his seat with 91 candidates on the ballot and a staggeringly high voter turnout of nearly 82% of eligible voters in his Carleton riding. Canadian pension fund Caisse de Depot et Placement du Quebec is seeking to sell a Chicago office tower 59% lower than last purchase price 8 years ago. California decriminalizes welfare fraud and weakens proposed punishment for teen sex solicitation. Liberation day arrives on April 2nd. U.S. and Ukraine sign resources deal after tense negotiations. Soaring claims for weight-loss drugs raise concerns about private insurance plans. Tesla prices rise 20% in Canada (because of new Canadian government tariffs).

What Are We Buying? Selling? Holding… [by David Cox]

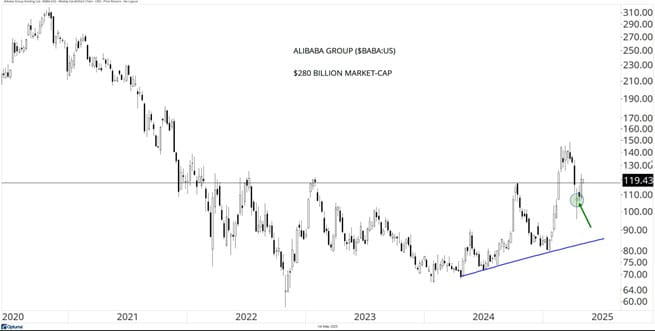

Foreign stocks have definitely been showing up on the relative strength watchlists for a while and the Chinese and Asian stocks first really came into my radar in the fall of ’24 during my trip to Asia, as news of Chinese stimulus drove market higher. That rally faded but has re-ignited and Ali Baba ($BABA), one of the mega-cap stocks at $280 billion in market-cap, embarked on a big rally earlier this year and I stared at it, having missed the boat. I don’t like to chase stocks, but as the hockey coach used to tell us, “Get a number!” and a ticker I did. BABA pulled back stiffly with the rest of stocks, as tariff and global trade war headlines made the rounds in April and the weekly chart remains in a higher highs, higher lows uptrend. We bought the pullback this past month in the #AllINsync pool and will see if the stock can continue its trend.

Source: Optuma

* as at April 30th, 2025

AllINsync: How Are We Exposed? [by David Cox]

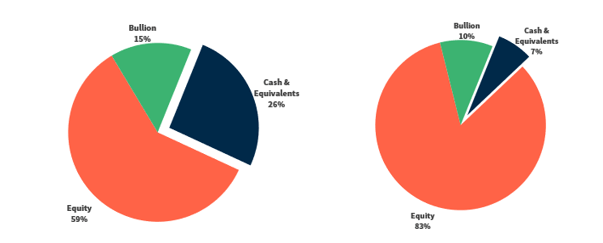

As stocks cratered hard in the post “Liberation Day” selloff and the volatility $VIX index spiked, fear ran high (and continues high, as we close out April, according to both the AAII fund survey and the CNN Fear and Greed Index (36 = fear)). That said, the stocks that behaved well amidst the sell (and fell less than the market) were identifiable and, given we were faced with a very oversold market on a big-picture basis, along with the magnitude of short-term selling, we went shopping in the #AllINsync portfolio. I updated the pie chart (below) and left the one from last month (left) for comparison. Our equity position went from 59% to 83% during April, our (gold) bullion position was reduced from 15% to 10% (mild trim to gold and sold the silver) and our cash pile went from ~26% to only 7%. Buy the dip in the face of fear?

Source: Croesus

* as at April 30th, 2025

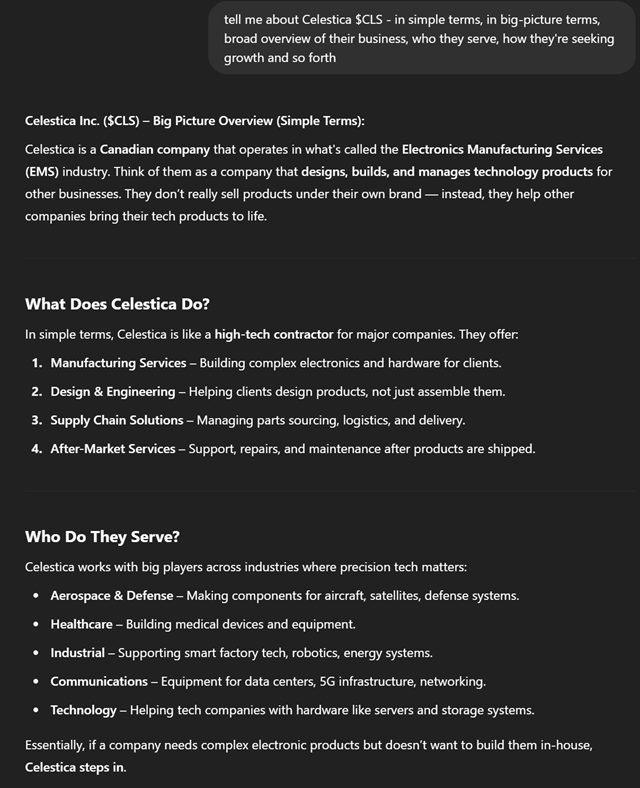

Artificial Intelligence -> Human Wisdom? [by David Cox]

What did I use ChatGPT for, this month? Knowing that Celestica ($CLS:TSX/$CLS:US) is a Canadian company in the #INsyncUniverse that has been extremely strong (for some time!), I finally became curious enough to learn more about what this company is up to. Instead of “googling” the company, being led to their corporate website, I, of course, turned to ChatGPT who can provide a more curated summary to satisfy my curiosity… Amazing how quickly we can get insights like this, these days, using artificial intelligence!

How’s the (Bigger Picture) Market? [by David Cox]

After reaching weekly oversold conditions for the first time since 2023, the S&P 500 has bounced from those weak levels as fear ran high. I’d argue that Trump’s “Liberation Day” announcements caused a huge wave of uncertainty and, a week later, he was forced to backpedal, as the bond market said this can’t work like this (i.e., bond yields spiked, which was the opposite of their plans). The bond market is huge (way bigger than the stock market) and like all the times seemingly before, it’s the government or the central banks ready and armed with solutions, band- aids and strategies deployed to stabilize asset prices. Bottom line, the S&P 500 has a lower low on the chart, though managed to climb back above the long-term 65-week exponential moving average (green), as we finished April.

Source: Optuma

* as at April 30th, 2025

Market Summary and Trend of “All Assets” - [by David Cox]

I love watching the markets and love analyzing them. Looking at the same data, with the same templates at a given and consistent periodicity, provides routine and I’d argue #marketpulse. Gold is up at the top of the leaderboard on a year-to-date % change basis and it’s foreign stocks that follow closely behind. With a weak U.S. dollar (globally) in the short-term, foreign stocks (measured below using the U.S.-listed ETFs, which contain not only the price performance but also the related foreign currency gain) have been shining. But will it continue? Trends are important and I never want to get lost in the day-to-day without knowing what the bigger-picture trends are. I show three time frames below (as always) and I hope you find it useful!

Source: Optuma

* as at April 30th, 2025

Sharing Our Tools of the Trade - [by David Cox] - UPDATED

Until the recent launch of the #AllINsync pooled fund, using options was not a practical tool that could be offered to clients or utilized in their accounts. Why? Options, by their nature, are more complicated, and the amount of energy required to formulate and execute on contracts with small value simply isn’t (wasn’t) practical. But then, #AllINsync arrived.

A put option provides an investor with the right (option) to sell a stock at a certain price until a fixed expiry date (like an insurance contract, if you think the stock might fall). In times of heightened volatility, this insurance is more costly and being a seller of such protection (to those that are expecting their stocks to keep falling) is wiser than paying exorbitant rates to buy the insurance. Confused? Think about it in practical terms. If you need hurriance insurance, yet opted to not purchase it, imagine how much the insurance company would charge you, if you called them when the hurricane was due to land in your neighbourhood – the price would be significant, if available at all!

The premium received is like adding money to your account, and for that money, the put seller takes on the obligation to buy the stock if it should keep falling (down to or below the strike price). Please understand that I’m selling these put options on stocks at levels that I’d be happy to buy if they continued falling. It’s like putting in a limit order to buy at a lower price, except by selling the put option, you’re paid to wait.

We are short three put options right now, on Tesla ($TSLA), Spotify ($SPOT) and Z Scaler ($ZS). The yields are quite attractive and are a tool to build a more efficient, risk-adjusted portfolio as I see it!

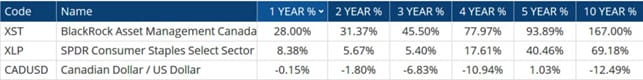

One UPtrend, One DOWNtrend - [by David Cox]

Consumer staples are typically regarded as “defensive” and tend to refer to the companies that make the products that are staples to many households (think food, grocery stores, dollar stores, alcohol and tobacco) [and yes, I realize the latter two are not necessarily staples in your household!]. Either way, we always want to compare our options.

Any serious consumer staples stock participant in the U.S. needs to acknowledge and be aware that Canadian consumer staples stocks have dramatically outperformed over the 1, 2, 3, 4, 5 and 10-year time frames. I mean, significantly! In the table below, I’m using the $XST (Canadian consumer staples) and comparing it with $XLP:US (SPDR Consumer Staples), and look at the performance differentials! I even included the Canadian dollar, so the weakness (from an American vantage point) can be understood. That said, all in, the results have been dramatic. That’s called relative strength and an example of a relative uptrend (if I were to plot one dividend by the other). There are, of course, differences in the levels of diversification of these two ETFs and I’d encourage you to do more digging if you’re interested.

Source: Optuma

* as at April 30th, 2025

Chart of the Month - [by David Cox]

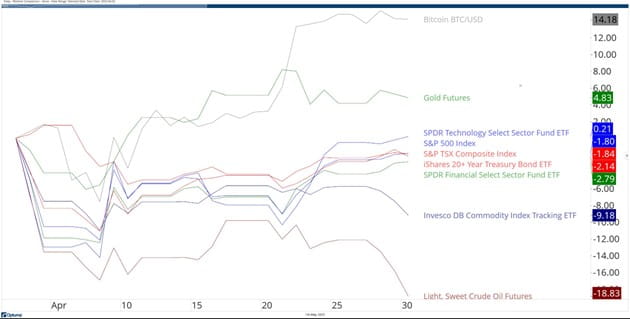

Trump called April 2nd, 2025 “Liberation Day” and I don’t know whether it will stick each year going forward, but either way, stocks tumbled on the news (I think we all know that by now, and certainly, you’ve learned that if you’ve read through to this point). I thought it would be helpful to see what the returns have been since that day, which tells us and shows us what assets investors have preferred (i.e., bought and paid higher prices for) and which assets have instead fallen.

Bitcoin performed extremely well and is +14.2% since that day (about a month ago), gold +4.8% and technology stocks ($XLK) (which have been relatively weak for 6+ months) actually rose marginally against the negative price action of U.S. and Canadian stocks. Crude oil tumbled (good for those of us that buy gas at the pumps!) and, on that note, Canadians beware of the Liberals taking too much credit for cheaper gas prices after the carbon tax was removed, causing falling crude oil to reduce our pump prices considerably on its own!

Source: Optuma

* as at April 30th, 2025

Social Media and Our Website - [by David Cox]

I was invited as a guest on CNBC Arabia earlier this week, which broadcasts from its headquarters in Dubai, United Arab Emirates. As I waited for my spot to begin and watched the feed beside me, I quickly realized that, indeed, the program was in Arabic and I silently hoped they realized I have no Arabic to offer! Just as that thought was crossing my mind, a translator came on to check if I was going to want to have the questions translated (giggling, I, of course, said yes!) and went ahead with the interview. We talked about stocks, volatility in the face of global trade war headlines, oil prices and they asked about gold and Bitcoin. I can’t find the link online (would be perhaps easier if I could read Arabic!) to know if it even exists but here’s a snapshot I took after, from my phone!

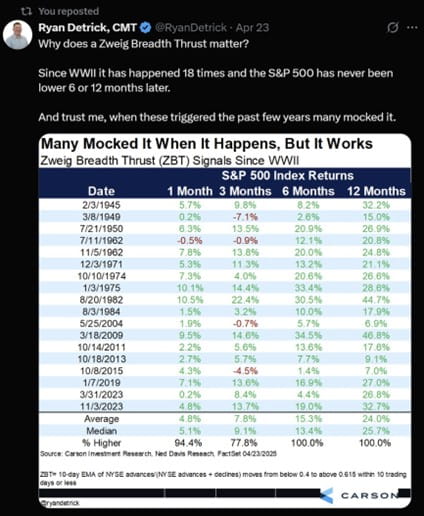

Ryan Detrick @RyanDetrick posts some great content on “X” (formerly Twitter) and given we had what is called a “Zweig Breadth Thrust” he did what he usually does and shows the results of past market action after such a condition and I think you’ll see it quite positive. Being a fellow technician, you’ve heard me too, talk about market breadth and buying thrusts and that’s exactly what he’s referring to. Dr. Martin (Marty) Zweig was a very successful advisor, analyst and trader in his day and passed away in 2013. Here’s an added article for your interest!

Upcoming Dates, Seminars, and Announcements - [by David Cox]

What: “Nomad Capitalist Live”

Where: Kuala Lumpur, Malaysia

When: September 17-20th, 2025

Who: I’m going again!

What: “CMT Global Summit”

Where: Dubai, UAE

When: October 1-3rd, 2025

Who: Yours truly will make a second trip to this exciting part of the world!

What: “Canadian Bitcoin Conference”

Where: Montreal, PQ

When: October 16-18th, 2025

Who: This was a great, and quite intimate (~350 attendees) conference last year, and I’m looking forward to attending again.

Thanks for taking the time to read our “Monthly INsync Chit Chat” and a reminder that I always appreciate your feedback! Thanks in advance!

Sincerely,

David Cox, CFA, CMT, FMA, FCSI, BMath

Senior Portfolio Manager, Wealth Advisor

Raymond James Ltd.

Phone: 519.883.6031

Unit 1 – 595 Parkside Drive I Waterloo, ON I N2L 0C7

www.financiallyinsync.com

![]() @DavidCoxRJ

@DavidCoxRJ

Disclaimer: Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Financially INsync Team, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Statistics, factual data and other information are from sources believed to be reliable but accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James Ltd. is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities.

Raymond James Ltd. is a Member Canadian Investor Protection Fund.

Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd., member FINRA/SIPC.