Monthly INsync Chit Chat October 2025

A Busy Summer -> A Busy Fall! [by David Cox]

My schedule this summer ended up containing a few extra trips (and weeks!) than originally planned but it really offered a chance to take the kids to see a few sights here and there, and further work on that work/life balance thing! We did a road trip down to Washington, DC, Philadelphia & Baltimore that included a couple of baseball games, a tour of the first jail in the U.S., incredible artifacts and history at the Library of Congress/Museum of Archives/++ and the kids were awed at some of the creatures and exhibits at the Baltimore Aquarium! I also caught a couple of Phish shows in Saratoga Springs and watched thoroughbred racing at the historic Saratoga Speedway! My trip to Italy to celebrate my middle son Asha’s (18) high-school graduation was also spectacular and the history and character wandering the streets of Florence, Rome & Venice really were something! (I am left to wonder what everyone does there besides eating, drinking and socializing) but what a great culture!

I’m writing this on the plane as I return from the Nomad Capitalist conference in Kuala Lumpur, Malaysia, which was another great opportunity to widen my lens with a global perspective on how politics and economics are re-shaping trade and power creating both risks and opportunities for every one of us. The world is so much bigger than the cities (and countries!) that we reside in and I consider it my responsibility to ensure my understanding, which flows through to my advice, considers a wider perspective beyond our own borders. A week back in the office before heading east to Dubai for the second year in a row as I am set to speak at the CMT Global Summit as you read this. Let’s get to it!

News – Some That You’ve Heard, Most That You Haven’t - [by David Cox]

Charlie Kirk, an articulate young man and father was assassinated In Utah, while doing what he always did – speaking to those on both sides of the political aisle, challenging thinking and beliefs. Most concerning, many expressed pro-violent and support for his killing evident of how polarized and on edge society is. Canada puts 25% tariffs on pickles that are bottled in Wisconsin, crushing Ontario farmers who sell 16 million pounds of cucumbers each year to Bick’s. Canada’s Prime Minister, Mark Carney makes a bold statement that “Muslim values, are Canadian values”. The U.K. plans to introduce a digital ID, presented as a way to stop illegal immigration, but offering tremendous intel on all citizens, their conversations, their whereabouts, their social media views and beyond. The U.S. economy expanded at +3.8% in the second quarter, much stronger than expected. Centurion REIT, a ~$7.2 billion dollar pool of real estate capital based in Toronto halts (severely limits) redemptions as liquidity tightens and demand for return of capital grows (I always like to say that I love liquidity, Centurion REIT seemingly doesn’t have any, nor do its investors wanting their money back).

Book Corner [by David Cox]

I’m always trying to keep learning and while I also like the idea of reading some fiction, I’m regularly drawn to the non-fiction stuff and of course, anything (and everything) related to finances, economics and/or investing. I was finishing up Dan Passarelli’s book called “Trading Option Greeks” as I sat down on the 2nd plane home from Malaysia and was about to leave Japan when the young man to my left remarked that he’d read the book! Not what I’d expect to be a common read, we of course, started chatting.

I was most impressed with his acumen, as a mid 20’s market enthusiast who had been intently learning everything he could about investing and had developed himself into trader with some excellent insights that I not only wholeheartedly agreed with, but knew I’d taken literally decades to learn!

I never studied Greek in school, but anyone that knows anything about option trading at all knows that the greeks (delta, gamma, theta, vega and rho) are important and as I continue to explore ways to utilize options in our #AllINsync (RJI237) investment pool, I am reading about options (almost all of which 99% of you would find utterly boring – I’ll take one for the team!)

But alas, I take my job seriously and just because I’ve been at it for decades (and am now in my 50s), there are always new things to learn and I don’t ever want to let clients down by not trying to learn them!

Wellness Wins! - [by Avery Kelly]

Coming from an athletic family and having recently retired as a varsity athlete myself, I’m always on the lookout for new ways to stay fit and weave movement into my daily routine.

After attending the U.S. Open this year, I discovered that tennis is often crowned “the world’s healthiest sport.” At first, I thought that claim sounded far-fetched. But a 2018 Study showed that tennis players enjoy greater gains in life expectancy compared to those who play soccer, cycle, or swim.

When you break it down, tennis delivers cardiovascular bursts through sprints, sharpens hand- eye coordination, builds arm and core strength, and fosters social interaction - all in one game.

Back in Waterloo, I dusted off my racquet and arranged a few matches with friends. Even a three-set match left me EXHUASTED - proof that tennis is as much a full-body workout as it is a cardio sweat session.

Whether you’re blasting 135 mph serves like Rafael Nadal or simply rallying against a wall, tennis guarantees effective movement and a healthy dose of social fun, no matter your age.

What Are We Buying? Selling? Holding… [by David Cox]

Chinese stocks! Some of you know that Chinese stocks aren’t what I consider to be the easiest of stocks to manage as history has shown them to be rather volatile and subject to unexpected headline volatility that can move the entire basket of them from financials to technology without notice. But, more signs of strength, following up the buying demand that appeared in the fall of ’24 is there(here) and with it, comes our capital. With the new opportunity to strategically use options as a means of better managing that volatility in the Chinese space, we’ve found ourselves exposed in a number of spots including Alibaba ($BABA), Xpev ($XPEV), JD.com ($JD), Kingsoft ($KC), PDD Holdings ($PDD) and Nio ($NIO), another Chinese electric car maker. The ETFs also can provide a more diverse way to participate and if you’re looking to do some research, I could suggest $FXI or $CQQQ as broader ways to contemplate potential exposure in China.

Alibaba is a rather large company at almost $400 billion and it’s recently broken out of a multi- year base (see chart below) and left a bottom in its wake. We’re long and we’ll stay that way until the market tells us otherwise.

Source: Optuma

* as at September 26th, 2025

Getting AllINsync: Wills – Why are they important? [by Kieran O’Donnell]

Over the past few weeks, I have found myself in various discussions about wealth (how to grow it, how to protect it) and its importance is acting like a rising trend, especially as I’m relatively new to the industry. Although investments are mainly the forefront of these conversations, one of the most important parts of wealth management often gets overlooked: estate planning. It’s one of those topics that often get pushed aside until something happens. But the truth is, wealth management isn’t just about growing wealth; it’s about protecting it.

One of the most important ways to protect your estate is with a will. A will might seem small, even unnecessary – but in reality, it’s one of the most critical parts of your estate plan.

A will is a legal document that ensures your wishes are respected, your loved ones are protected, and your legacy is passed on the way you intended. When writing one, you’ll want to clearly indicate who in your family receives what (this could include specific items, a percentage of your total estate or a combination of both). Your will should also outline your wishes regarding your body and funeral services. Also, if applicable to you, it should name guardians for children or dependents. Finally, to carry out all these instructions, you’ll need to name an executor.

An executor is the person who is responsible for carrying out the instructions in your will. They can be a family member, a trusted friend or even a professional, such as a lawyer or trust company. No matter who you choose, what matters most is that they are someone you trust to handle your affairs with care and integrity. The role requires someone who is organized, trustworthy, and emotionally capable. Essentially choosing the right executor helps ensure that your estate is settled smoothly, and your wishes are fulfilled without unnecessary delays or complications. A rising trend in recent years is the use of a corporate executor, which can provide longevity, confidence and certainty with knowing your wishes will be handled in an objective, professional and competent manner. Check out this link to see the different tasks that Raymond James can assist with as a corporate executor. Many of these tasks are often overlooked hence why more families are choosing corporate executors. It is a way to relieve the burden of the administrative duties in an already difficult time.

Not planning properly can lead to serious complications, both emotional and financial, for your loved ones. Without a clear plan accounts can be frozen, court battles can arise and delays in the settling process can not only become inconvenient but painful in an already painful time.

If you have a will, or it’s been a while since you have updated it, now is the time. It’s a proactive step that speaks volumes about how much you care for your family and your legacy. A will, with a strong choice of executor and a clear plan are the cornerstones to a complete estate plan and ultimately a complete financial plan. It ensures your voice is heard, your values are honored, and your loved ones are supported.

Things We Recommend - [by Avery Kelly]

As a Gen Z individual, I find myself constantly downloading new apps to make life easier. Whether it’s discovering a new café for a coffee, tracking my workouts or booking travel, you can bet I probably have an app for that.

This quarter’s fixation? Gametime. An app that lets you snag last-minute tickets for professional sports, concerts, and everything in between. I’ve used it to purchase tickets for Major League Baseball, the orchestra, a country music festival, Broadway shows, and professional hockey games, and I’ve found it incredibly helpful. There’s no need to worry about forgetting passwords when accessing your tickets later – they’re all stored in one place.

Whether you’re like me and attend similar events or just looking for a reliable way to book spontaneous outings, I think this app is a game-changer for people of all ages. You can buy verified tickets up to five minutes before the start of the game, show, or concert.

I’m not here to sell you on any one app - I’m just hoping to share the tools that have genuinely made my day-to-day a little smoother. If even one of them helps you discover something new, that’s a win in my book.

Artificial Intelligence -> Human Wisdom? [by David Cox]

What did I use ChatGPT for, this month? Firstly, I must admit a deep frustration in recent months as my desktop computer at home has been unable to access ChatGPT amid repeated warnings about unsafe connections and/or “hackers may be trying to steal your information” stopping my persisting attempt to get in. Argh. I don’t have a lot of patience for technical issues and the AI chatbot, google search/help/etc. have yet to solve the problem, so I’m left with only my phone.

I had a great lunch with a fellow investor (and options enthusiast) in Malaysia, whom I met the year before at the China IFTA Conference and he was explaining to me about how he was creating his own GPT. I didn’t understand this of course, but have queried ChatGPT itself on the idea, and it seems like this is an opportunity that I’ll be seriously considering. Being able to train AI to think and act like I do, based on my past actions, writings, my research, investment process and so forth can contribute to the development of a personalized GPT can be built allowing others (you!?) to dig more into more about what it is we do at Financially INsync (and how we do it!) and essentially communicate with me, indirectly(!). I know, sounds a bit crazy. More to come I expect!

How’s the (Bigger Picture) Market? [by David Cox]

The market remains in a strong uptrend, and unlike a year ago, the U.S. stock indices have been joined by (most) other global stock markets from east to west, north to south, and really has broadened into much more significant evidence that risk assets are in demand.

Ever since the first rally off the fall ’22 bear market lows, there are (still) many calling for tops and peaks and so forth, but you know me, we’ll take demand vs. supply and the chart every time and the market has been very robust. We still have more than 60% of stocks in the S&P 500 above their 200-day moving average and while the focus sectors haven’t changed much (technology, communication & discretionary), demand for stocks remains (and the chart of stocks vs. bonds continues to trend upwards) too.

September/October are often volatile and have seen more than their share of volatile selloffs, we haven’t seen anything remotely characteristic of that so far in 2025.

Source: Optuma

* as at September 26th, 2025

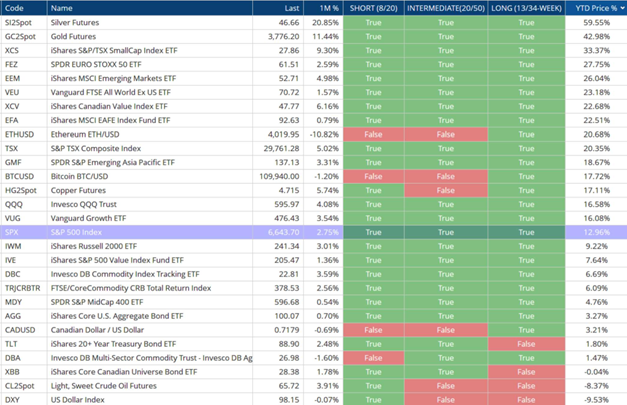

Market Summary and Trend of “All Assets” - [by David Cox]

Almost all trends are upwards. The few (and very rare) exceptions are oil, the U.S. dollar index and copper (though copper sure looks odd, having surged to all-time highs before harshly reversing back downwards – meanwhile, copper stocks themselves are breaking out and higher, outperforming!). The whole point of using a trend classification table like below is to take the emotion out of investing, to remove the narrative some of you are hearing as economies like Canada struggle, or tariffs cause some businesses pain and/or new wars develop, and to instead accept that greater demand for assets (of any colour, shape or size) tends to push prices higher and it takes an act of opposite proportion (i.e. selling pressure) to allow markets to peak and subsequently decline. We’ll forget our reasons at the door and accept that this year, gold and silver have been very strong and stocks too, quite so, also now marking the 3rd year in a row of strength.

Source: Optuma

* as at September 26th, 2025

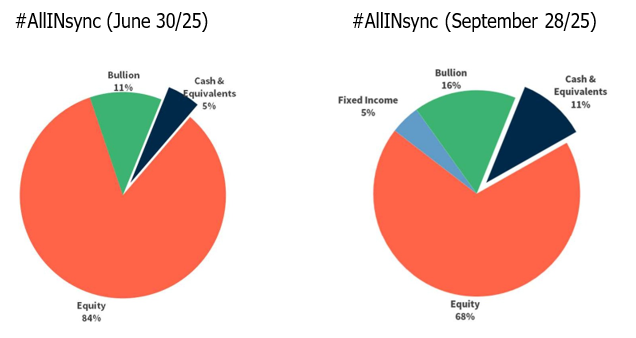

AllINsync: How Are We Exposed? [by David Cox]

As we finish the third quarter ended September 30th, one thing is certain, it’s been a very strong quarter which came (again!) in the face of very weak sentiment. While the Canadian dollar indeed bottomed early in 2025, it is NOT in an uptrend as I see it and as such, we as Canadian investors, can understand there is diversification by having exposure to foreign currency. We have increased our foreign holdings and have really been tackling the opportunities in more volatile growth (& China!) stocks using a combination of strategies including: buying call options and selling put options. The latter allows us to collect income by taking on the obligation to buy (at a lower price) and both of these strategies allow us to put a smaller amount of capital at risk and to more flexibly handle short-term, potentially violent price action without premature stop losses being triggered. Our gold and silver bullion positions were added to this past quarter, while also rising in proportion due to strength and currently represent ~15.6% of the overall portfolio.

Our cash position is higher than last quarter, although some of that is required coverage for the put option obligations we have outstanding and we have also bought into U.S. long bonds after the impulsive move higher during the quarter.

Source: Croesus

* September 26th, 2025

Chart of the Month - [by David Cox]

Years ago, in 2020, Cathie Wood developed an almost iconic status after making popular her strategy of investing in the innovate companies re-shaping the global world that we live and work in. But most investors caught on far too late, and the money flows show that despite the incredible returns, most investors became losers over the years as $ARKK fell ~-82% and Cathie made clear (based on her continually disclosed portfolio holdings) that she does not manage risk (not her words, but speaking from her positions/actions) and instead sticks to her conviction (although I admit I saw some of those stocks she had been convicted about being finally sold after losing -90% or worse, but I digreess…).

Ever since, I still follow these ETFs and think they are important, perhaps as investment vehicles but also as barometers that can provide context to the character of the stock market at any given point in time. In recent months, we’ve seen a massive, multi-year breakout of the ARK Innovation ($ARKK) ETF vs. the broad S&P 500 and against the SPDR Technology $XLK sector itself. I cannot help but continue to see this as very important information that I can’t let us miss and I think suggests that investors continue to be best served by focusing on growth securities and remaining bullish for the current market cycle. In the chart below, we can see that after the recent breakout, a small pullback took place and we are continuing to see that relative strength continue. I won’t be surprised if we see this ratio climb higher in the coming months and that would be bullish news, more broadly, for investors.

Source: Optuma

* as at September 26th, 2025

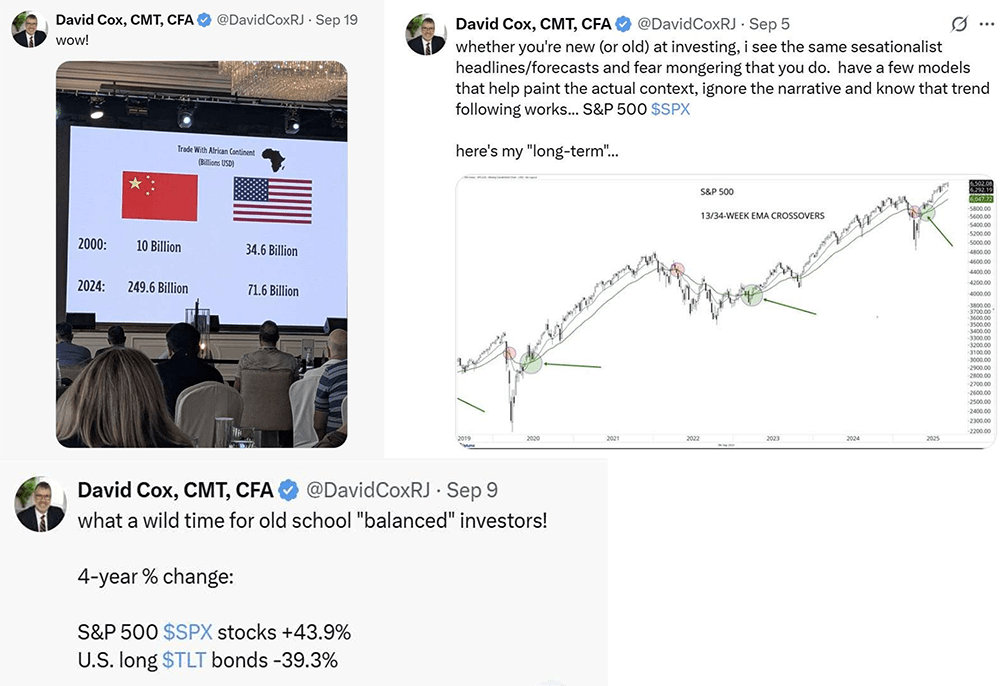

Social Media and Our Website - [by David Cox]

We’ve continued to make some updates to our website (www.financiallyinsync.com) to showcase our team, and to better collect and share our thoughts, and make clearer what it is we do for clients (and how we do it).

At times when my schedule is too busy, my twitter feed does tend to slow down some, but I’m always trying to share perspective and insights about what I’m seeing. Some of you perhaps noticed that I regrettably had to also stop allowing all responses on X given the excessive and frustrating amount of bot traffic despite my routine willingness to dialogue with anyone posing genuine questions, challenges or critiques of my charts, or opinions.

Here are a few recent posts that got some attention:.

Upcoming Dates, Seminars, and Announcements - [by David Cox]

What: “CMT Global Investment Summit”

Where: Dubai, UAE

When: September 30th - October 2nd, 2025

Who: I am likely in Dubai speaking at the conference as you read this! My topic: “Taking Risk is Easy. Understanding Risk is Hard.”

What: “Canadian Bitcoin Conference”

Where: Rialto Theatre, Montreal, PQ

When: October 16-18th, 2025

Who: I’m very excited to be joining other Bitcoin enthusiasts and/or curiosos for the second year in a row!

What: “Raymond James National Business Conference”

Where: Vancouver, B.C.

When: October 27-30th, 2025

What: Visiting Clients in B.C.

Where: Rossland, B.C.

When: October 30th – November 4th, 2025

Who: I’m looking forward to seeing many clients while out west!

I hope you’ve found a way to enjoy a column or two of our “Quarterly INsync Chit Chat” and I myself am excited to see my new team (Avery & Kieran) adding contributions this quarter! Please don’t hesitate to provide us with your feedback (good or bad!), and we thank you in advance!

Sincerely,