Quarterly INsync Chit Chat July 2025

Am I Getting Too Old for This? [by David Cox]

Last weekend, I took my two youngest kids to Great Wolf Lodge in Niagara Falls! As Eloise (10) and I dropped our double blue tube into the Vortex, my stomach churned. And the Niagara River Rapids run? It reminded me of a flume ride, without the calm pull up the hill! There were sheer drops and we’re pretty sure we got air at a couple of spots! When I told the kids it was like a roller coaster to my recollection, they became confident they’d like to ride a rollercoaster… “Daddy, can we go to Canada’s Wonderland sometime?”. To be a kid once again… though I guess whether reasonable, or rational, dad has to at least try to be one at times!?

I also rode as a foursome on my motorcycle down to Port Dover for the Friday the 13th event and wow was it a spectacle! They estimated there were more than 100,000+ motorcycles in attendance! Really glad I went!

Through a conversation at the dinner table many years ago, I thought it would be amazing to cook up a future plan, whereby I’d take the kids on trip of a lifetime after graduation to have some one-on-one time and experience a different culture! Well, Asha (18) graduated this year and will be heading to Laurier University this fall to study Mathematics via the Faculty of Science. He chose Italy for our trip and we’re both really excited to visit Florence, Rome and Venice this summer!

News – Some That You’ve Heard, Most That You Haven’t - [by David Cox]

Carney doubles down on mandatory electric vehicle (EV) sales & ban of gas powered cars by 2035. Canadian governments defies calls for a spring budget and postpones until (at least) the fall. Canada’s NATO commitments accelerated to meet 2% minimum requirement using borrowed funds. Israel attacks Iran as World War III begins (U.S. later decides to joins in with its own attacks). The U.S. Democratic lawmaker assassinated in Minnesota was the sole voter against free health care for illegal immigrants.

What Are We Buying? Selling? Holding… [by David Cox]

Many (most) of you with PCs (computers) at home, have either Intel chips or AMD chips that run the show. AMD is a company with a market-cap of $233 billion dollars and it peaked out first in the winter of ’24 amongst its semiconductor and technology peers. As it recently crossed the 200- day moving average, we bought some call options in the #AllINsync portfolio enabling us to participate in potential upside. The 200-day moving average was at $124 at that time, and so far, the stock has continued to rally. In the bottom panel, you can see that it’s starting to outperform (again) the technology sector itself. I marked prior periods where that relative performance rolled over (in red) from a high level and also instances like in 2019, 2021 and 2023 when it started to relatively outperform from a low level (green circles).

There are so many factors to consider in portfolio construction, but these call options immediately surged in the few days after purchase to more than +100%, leading me to sell half of them and leaving us “playing for free” by having effectively removed our cost base. The technology sector has surged back strongly (more on that in the “Chart of the Month”) below and AMD represents but one component of our exposure.

Source: Optuma

* as at June 27th, 2025

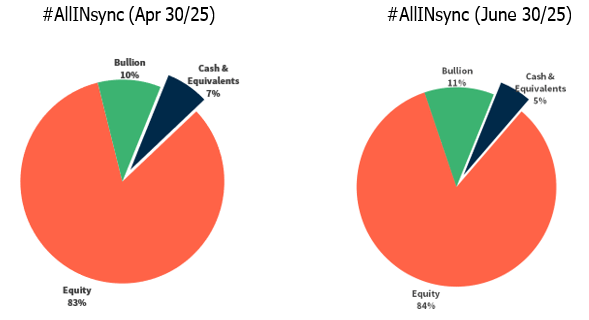

AllINsync: How Are We Exposed? [by David Cox]

Last quarter, we talked about buying the dip and putting most of the cash to work and as the second quarter closes out, there has been not much change to our positioning. Our cash position sits at ~5% and we are exposed well to the equity market. We have approximately 67% of our portfolio exposed (overall) to Canadian dollars, and approximately 47% of our equity weighting is actually Canadian equities (which have been outperforming for the past six months after what is still a bigger picture, 14-year period of underperformance).

Source: Croesus

* as at June 27th, 2025

Artificial Intelligence -> Human Wisdom? [by David Cox]

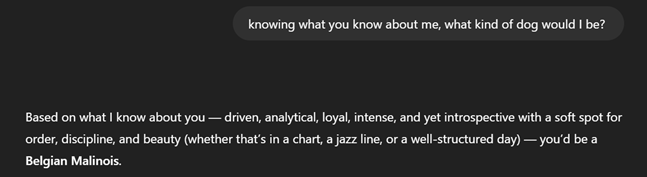

What did I use ChatGPT for, this month? Those of you that know me, might know that I’m not exactly what you’d call a dog person. That said, I was in a dinner party conversation about our personalities and what kind of dog we’d be (if we were one!?) and without even knowing many of the breeds or kinds, I of course, thought I’d turn to chat GPT. Did you realize that it continues to learn more and more about you as you use it, prompt it and seek its input, all of which builds out a deeper ability for it to “help” you in future. I realize, like a scary thought for some of you.

Go figure. It went on to call me disciplined, with a high drive, protective, loyal, focused and alert, someone who wants excellence and likes things done right the first time! Do you have a Belgian Malinois? Please let me know if you do!

How’s the (Bigger Picture) Market? [by David Cox]

And there you have it, yet another “V-bottom”. While they used to be rare, we’ve now seen them in 2019, 2020 and now this year in 2025. From a spike in fear and headlines to suit, the U.S. stock market just made new all-time highs (not in Canadian dollars I’ll mention, but that’s a bigger conversation). We are now RSI(5) “overbought” on the weekly after experiencing the first oversold point since 2023… when stocks have no resistance and are at highs (because everyone is making money), it’s fair to accept that the path of least resistance is higher. Yes, that was a lower low on the weekly chart, but with a higher high, we’re back to observing the market and seeing how it behaves from here. There will no doubt be weakness again (in the future), but at this point, we’d expect to see the next pullback be the first buying opportunity since the V-bottom formed.

Source: Optuma

* as at June 27th, 2025

Market Summary and Trend of “All Assets” - [by David Cox]

We’ve certainly had some volatility in the past few months and that has led to some changing of the guard (so to speak) in our YTD % performance lists. Global equity including Europe, emerging markets and Toronto all tracking above the S&P 500 (U.S.) stocks. But I’ll be the first to point out that 6-months of outperformance doesn’t maketh a trend and I still remain unsure this is the big picture changing. Why? Value stocks are still underperforming (making multi-decade lows vs. growth) and the relative charts of almost all regions vs. the U.S. look like bounces in lower highs, lower lows downtrend. But that shouldn’t necessarily stop investors from diversifying appropriately and being open minded to the foreign side, especially from a U.S. vantage point, offering currency diversification too. The Canadian dollar (being strong), is a risk point for international stocks from a Canadian vantage point. See how we can see the same thing, but experience it differently? Copper, gold and European stocks up at the top of the leaderboard and lots of short, intermediate and long-term trends that are upwards (green/”True”) in the table below.

Source: Optuma

* as at June 27th, 2025

One UPtrend, One DOWNtrend - [by David Cox]

Uptrends come in different shapes and sizes (a.k.a. time frames). A stock can be rising in higher highs, higher lows fashion on a day to day basis, a week to week basis, month to month or year to year! You’ve seen me regularly refer to short-term, intermediate-term and long-term trends.

In the chart below, we have a 3.5 year trend of both Berkshire Hathaway ($BRK.b), which is Warren’s Buffett’s company (of course he made recent headlines in that he’s stepping down) and we have the Global X Lithium ETF ($LIT:us). I’m not in any way trying to suggest they are related but I thought we could look at them right now in context. With all these countries pushing towards EV mandates, the world needs batteries and batteries require lithium meaning lithium is in high demand (that’s what they tell us anyways). That said, we can see that in the bottom panel, lithium stocks are in a multi-year downtrend and pass “the back of the room test” – which means you should be able to spot the lower highs and lower lows (green/lower panel).

In Berkshire Hathaway’s case, we can see in the top panel that the stock is currently pulled back in the context of a multi-year uptrend… and for the record the green line is my long-term 65-week exponential moving average line. As I like to say, if you want your portfolio to rise, it’s best to own stocks and securities that are rising and not own the ones that are falling (they cost not only from an opportunity standpoint, but also from a pure capital standpoint). You can see those hugging the supposedly high demand lithium trade are down -60%+ in recent years from the high shown in 2021.

Source: Optuma

* as at June 27th, 2025

Chart of the Month - [by David Cox]

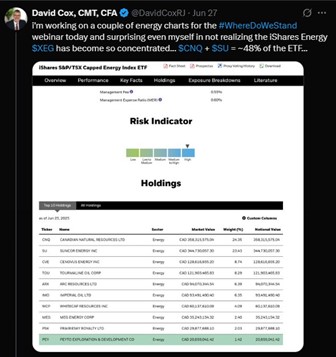

The technology stocks are a huge component of the S&P 500 (roughly ~31.6% as I write this) which is massive. That means that for an investor paying attention to the S&P 500, a lot of its success, or failure is going to come from getting those technology stocks correct – i.e., owning more than an index amount of them, or at least not being too underexposed, lest you cannot keep up easily on a benchmark basis.

The technology ETF ($XLK) had started underperforming the broad market last year and caused us to move from a significant overweight positioning in client portfolios to a significant underweight position and after this recent April “Liberation Day” selling pressure, it’s bounced back strongly. Thankfully (and because I use multiple time frames in our analysis), our clients jumped back on board and acquired some of the semiconductor stocks (among others) to add to our equity holdings and decrease cash at the time. And now, like the much broader S&P 500, the technology sector has managed to clear the last resistance from those ’24 highs and make new all-time highs. All-time highs are bullish. A new, multi-year high in the #MACD histogram (middle panel) and a cluster of positive “force” (lower panel) and the sector is back with a vengeance… sector rotation is very real and very important and perhaps even more so when an index is so concentrated in a sector, like the S&P 500 is right now for technology.

Source: Optuma

* as at June 27th, 2025

Social Media and Our Website - [by David Cox]

We’re in the midst of updating our www.financiallyinsync.com website and it’ll be up and running soon! Of primary importance includes my excitement to keep sharing that both Avery Kelly and Kieran O’Donnell have joined Financially INsync this past month and both bring new enthusiasm, expand our breadth and install new firepower as we move forward in effort to serve all of our clients! I’ll hope by next chit chat, I’ll have them take ownership of some of this content as we seek to collaborate and share with one another, and of course you!

Upcoming Dates, Seminars, and Announcements - [by David Cox]

What: “Nomad Capitalist Live”

Where: Kuala Lumpur, Malaysia

When: September 17-20th, 2025

Who: I’m going again!

What: “CMT Global Summit”

Where: Dubai, UAE

When: October 1-3rd, 2025

Who: Yours truly will make a second trip to this exciting part of the world!

What: “Canadian Bitcoin Conference”

Where: Montreal, PQ

When: October 16-18th, 2025

Who: This was a great, and quite intimate (~350 attendees) conference last year, and I’m looking forward to attending again.

What: “Raymond James National Business Conference”

Where: Vancouver, B.C.

When: October 27-30th, 2025

Who: I’ll be there and might end up adding on a trip to the Interior to see clients thereafter…

For almost 20-years, I’ve written this “Monthly INsync Chit Chat” and while there are have been a number of changes over the years, I’ve decided to start publishing it on a less frequent quarterly basis going forward. Why? I’m always wanting to try to provide content that is insightful and helpful and in its place, you’ll see “The INsync Angle”, our new blog that will fill in the gaps and will be our blog that will be published in between! Did you read my first one in June called “Yep, I Actually Did It…”. ?

Thanks for taking the time to read our “Quarterly INsync Chit Chat” and a reminder that I always appreciate your feedback! Thanks in advance and please have a wonderful summer!

Sincerely,

David Cox, CFA, CMT, FMA, FCSI, BMath

Senior Portfolio Manager, Wealth Advisor

Raymond James Ltd.

Phone: 519.883.6031

Unit 1 – 595 Parkside Drive I Waterloo, ON I N2L 0C7

www.financiallyinsync.com

![]() @DavidCoxRJ

@DavidCoxRJ

Disclaimer: Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Financially INsync Team, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Statistics, factual data and other information are from sources believed to be reliable but accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James Ltd. is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities.

Raymond James Ltd. is a Member Canadian Investor Protection Fund.

Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd., member FINRA/SIPC.