Quarterly INsync Chit Chat January 2026

QUARTERLY “INsync” CHIT CHAT

January, 2026

2026: Come Onnnnnn Down! [by David Cox]

Many of you know that I love the end of the year and the start of a new year! It’s a time to reflect and evaluate what was, and to think about what could be (or at least what we’d like it to be!). I’ve always been a resolutions type person, and while they’re not always resolutions, some are actually goals and objectives, I digress! As is common in my resolution lists, health is always up there and I admit I’ve slipped considerably in the workout and running department. Sure, I can blame my busy travel schedule or my bad back, but in reality, it’s about fighting procrastination and re-establishing a routine gone awry. Sitting around at Christmas time eating peppermint bark (Eloise & I baked it together!), drinking Egg Nog or overdoing the desserts and chocolates sure don’t help! I know, I know, some of you think we all deserve a treat or two and I’m too hard on myself!

My two youngest kids and I managed to spectate at a decent number of sporting events this past year and we capped it off with a overnight holiday trip to Buffalo to see the Sabres vs. the Islanders in what was Emry (15) and Eloise’s (11) first NHL game! Earlier in the year, we saw the Buffalo Bisons play (AAA baseball), visited the Baltimore Orioles (MLB) for a home game, followed by a trip to Citizen’s Bank Park to see the Philadelphia Phillies play the Angels, attended the Labour Day CFL match-up between the Hamilton Ti-Cats vs. Toronto Argonauts and finally(!) we went this past weekend to a KW Titans (Canadian pro-basketball) game! The NFL remains elusive but on our list!

News – Some That You’ve Heard, Most That You Haven’t - [by David Cox]

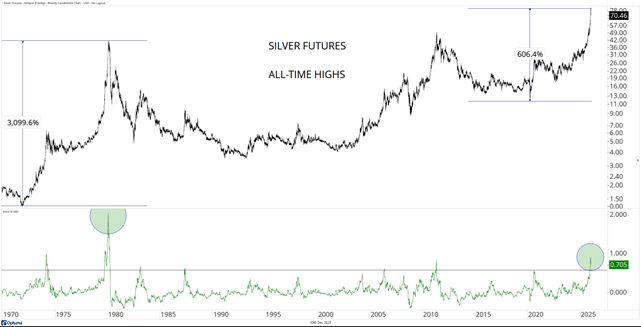

Silver surges to new all-time highs. Gold surges as central banks & governments continue to accumulate (except Canada who holds NONE). Ukraine attacks Putin’s residence with a drone swarm. The share of USD denominated assets held by other central banks of total foreign exchange reserves dropped to the lowest level since 1994. YouTuber Nick Shirley releases a bombshell journalistic piece demonstrating widespread fraud in Minnesota child-care and learning centres (all major media opted at first to not report on the situation, until it was clear that pretending it didn’t exist wasn’t tenable). U.S. defends free speech by banning five figures closely associated with European censorship from travelling to the U.S. stating they (the U.S.) will “no longer tolerate these egregious acts of extraterritorial censorship”. U.S. reports red-hot economic numbers and a +4.3% real GDP growth for the third quarter. Xi declares China’s economy set to hit 5% growth goal in 2025. Canada’s economy? Bueller? Bueller?

Book Corner [by David Cox]

I’ll be the first to admit that I usually strive to have at least read (finished!) a book before discussing it here, but this book, “The Sovereign Individual” really is a fascinating read and take on our world and how’s it has been changing and I’m finding it very insightful. In fact, I had to even look it up and was more impressed to find out it was first published in 1997. Those of you with young kids, surely find yourself like me so regularly saying things just simply aren’t the way they used to be and as time passes, the things we’re told to accept (or that simply are) don’t make a lot of sense.

The internet only came to be in the early 90’s, Apple iPhones weren’t a thing until the late 2000’s, Bitcoin arrived in 2009 in response to the financial system breaking and now, while Artificial Intelligence is all the (headline) rage, what’s really different?

Governments used to work for the people, and the taxes collected went to provide programs, stir innovation and developing learning and employment opportunities, but now? Governments spend well beyond their means, are constantly seeking an increasing amount of power and control over their own citizens, have introduced exit taxes & penalties for those who (try) to leave and the actual chunk of people

paying the bulk of the taxes don’t see much return on their contribution (nor do they reasonably expect to anymore) while those that are on the dole and are still similarly faced with the hidden tax that we instead term “inflation”. Needless to say, I think this is a must-read book and while I’m only half-way through, it makes you think (and I like to be forced to think regularly to keep my mind active!). Let me know if you’ve read it, or if you do end up picking up a copy!

Wellness Wins! - [by Avery Kelly]

Last quarter, we talked about the benefits of weaving tennis into your weekly routine. This quarter, I want to focus on something equally important: scheduling time for yourself! What does this look like in practice? As busy individuals, our calendars overflow with work, appointments, social plans, and family commitments. In many cases, especially around the holidays, it can become difficult to find time to complete the things that make YOU feel stress-free, energized and positive.

A few years ago, I completed the SMART Program (Stress Management and Resiliency Training). This 8-week course taught practical strategies for reducing stress and improving well-being. Each week we walked through various cognitive skills and interventions that can be used to positively impact our overall well-being. One powerful takeaway was the importance of scheduling time for yourself. This means physically putting this time to care for yourself into your virtual or paper calendar and committing to it! [Ed note: [DAVID] umm, perhaps I should sign up for this?].

No, I do not mean time to scroll on your phone reading the news or social media, but rather, intentional time when you can practice a variety of activities to help reduce stress and enhance your personal growth.

While completing the program, no matter how busy, I committed 1.5 hours each week to my own well-being! This helped me further understand that without putting that allotted hour and a half into my schedule that week, I would end up pushing meditation, yoga and self-care time away for other tasks.

The SMART program helped me further realize that when we don’t schedule in the time to take care of our body and our mind, our larger to-do list, and ability to complete tasks becomes more limited as we are not feeling our best.

Whether or not you explore the SMART Program, try blocking just one hour a week for activities that recharge you - meditation, exercise, or simply quiet time. Protecting that time can make a big difference in your energy and productivity!

What Are We Buying? Selling? Holding… [by David Cox]

When the year started, the Canadian stock market (a.k.a., Toronto) had been a serial underperformer for about 14 years running but fast forward a year and we’ve seen some significant outperformance and strength from Canadian equities! While one (strong) year doesn’t maketh a trend, I’ll be the first to point out that the way numbers work, short-term performance starts to have an impact on the longer-term numbers and sometimes it’s surprising how quickly!

While the long-term relative chart of Canadian stocks vs. U.S. stocks going back 45-50 years still leaves a lot to be desired (and looks like a downtrend), when we do focus in on 2025, we have to say uptrend (though squinting)! One interesting characteristic about Canadian equities, is that by any measure I’ve looked at (the “DC ATR” is my favourite risk/volatility gauge), the Canadian market is less volatile over time vs. U.S. equities. So when you find greater returns available, and at the same time appearing with less risk, investors need to pay attention. Am I willing to suggest it’s an all-in type moment and that the long-term trend (of relative weakness) is over for Canada? No. Am I open-minded to the possibility? Yes, of course.

Those of us in Canada that pay attention to economics, are aware that house prices are falling, developers are going bankrupt, GDP per capita is declining, most of the job growth in the past many years has come from the government and visits to the food bank have surged as prices spiralled away in response to massive monetary shenanigans (2020 money printing saw Canada inflate it’s money supply by ~+60%, a number off the charts so to speak!) would wonder how on earth the stock market is strong, but alas, it is. Those with assets have seen their net worths rise (that’s why they’re called inflationary assets), and those that only bought a house for the first time in the past 3-5 years, have seen their net worths (likely) fall. The gap is widening. I digress.

Our clients came into 2025 holding few Canadian equities, though made a number of adjustments and additions over the course of the year to head into 2026 open-minded for what could lay ahead. As cyclical stocks like mining stocks start to perform well (while energy stocks still remain largely weak, we could see even more strength in the market if they come to life). The banks (financial sector in Canada is ~> 30%) have done a good job of insulating themselves from housing loan issues by offloading their risk, using government entities and of course establishing the post financial crisis adoption of the “bail-in” legislation, so they seem apt to keep heading into the slowing economic picture without much let up on the gas pedal (and investors pushing their stocks in the same manner).

Source: Optuma

* as at December 29th, 2025

Things We Recommend - [by Avery Kelly]

As I am sure many of us have felt (especially those of us living in Canada), the winter days can feel extremely short. Waking up in darkness, only to see it return as early as 4pm causes many of us to struggle with continued grogginess.

I felt this personally and was introduced to a unique solution by one of my close friends. A sunrise alarm clock!

Instead of being awoken by a jarring alarm clock noise, this tool uses light and soft sounds to wake you up. Just set your wake-up time, and the alarm clock will create a soft, warm glow that progressively gets brighter over 40 minutes. This will signal to your brain that it is time to wake up!

Because sunlight plays a major role in regulating our body’s circadian rhythm, the sunrise alarm clock aims to mimic the natural awakening process. The combination of light and gentle sounds can be helpful for those who find themselves constantly hitting the snooze button in the dead of winter.

Here are a few of the top options from 2025! Let us know if you give it a try!

Artificial Intelligence -> Human Wisdom? [by David Cox]

Perhaps you recall my frustration last quarter about being unable to access ChatGPT and continually being told it was an unsafe connection? After deeper diagnostics by my personal father/son guru technology team (hi Gord & Rob!), it turns out it was Rogers, my own internet provider blocking me from using the tools by convincing me to use their “advanced security”. Hard to believe that for months I struggled to access something, wasting untold time and mental energy all the way it was my own internet provider (that I pay every month!) fettering my access.

I’ve been using Grok a lot now too as a parallel way to run ideas and gain insights. In fact, I can now use Grok in my car while I drive, and it’s remarkably easy to use in a conversational style allowing me to do anything from research, trip planning, studying history or even vocabulary practice as it gives me new words to learn, teaches me how to spell them (hard while driving for me) and how to use them in a sentence. It really is pretty cool to be able to drive along, learning and making good use of time without having to use my hands and/or be distracted. And they tell us we’re only in the infancy stages of what artificial intelligence will bring upon us.

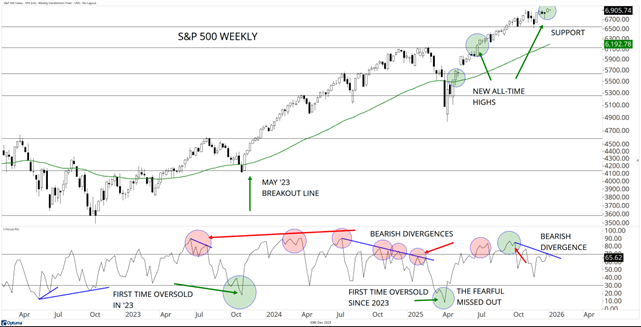

How’s the (Bigger Picture) Market? [by David Cox]

Nothing new to say, an uptrend is an uptrend and I will admit that the uptrend in equities has broadened considerably this year as more global markets have been participating. Though perhaps we should really just keep acknowledging that gold has outperformed most of those markets over many (most!?) time frames, from short to long-term. I believe this increased demand is foreign government buying, an erosion of trust in fiat (paper money) currency, and the desire for inflationary protection from a monetary environment designed to de-value our purchasing power. And yes, as discussed many times over the years, the real life examples of freezing bank account holders in Canada from the system or countries like Russia too, seeing their financial assets frozen or confiscated has led to a desire for other assets, and gold has no doubt seen new interest. Again, I poke fun at Canada (my own country) who owns no gold reserves of any kind. As gold keeps rallying, the purchasing power of some is growing, while others will keep relying on old(er) school monetary tricks to move forward.

Source: Optuma

* as at December 29th, 2025

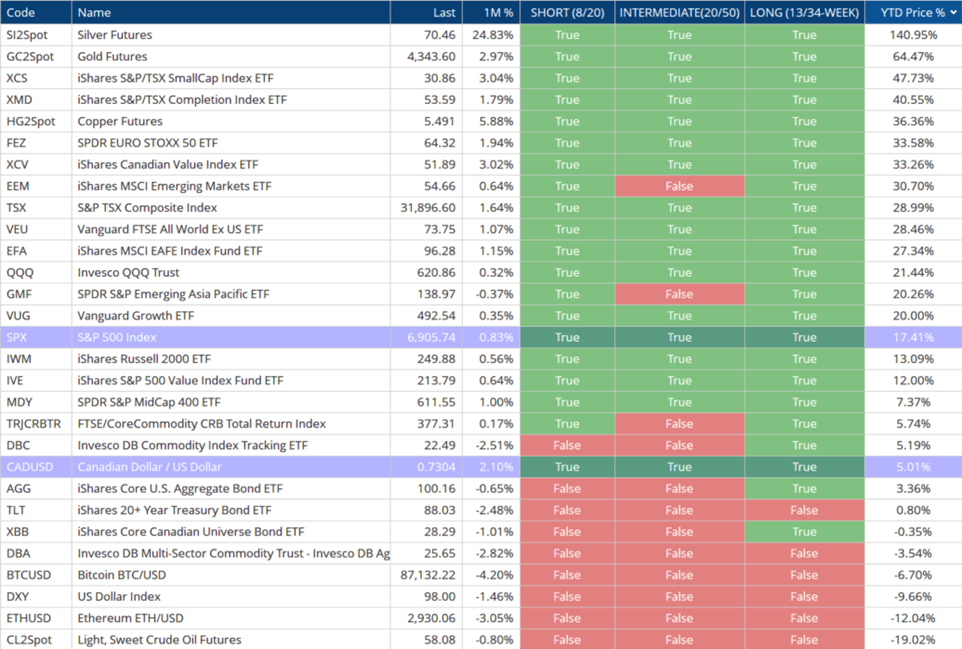

Market Summary and Trend of “All Assets” - [by David Cox]

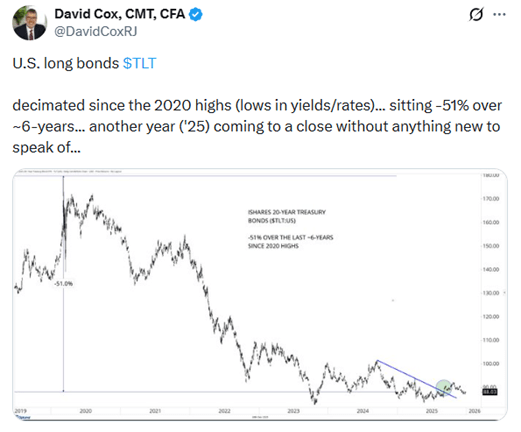

For the first time in recent years, Bitcoin has posted negative rate of return on a 1-year basis. As you can see in the table (below) which shows the short, intermediate and long-term trend condition of our “all asset” list, it’s near the bottom and the year-to-date % loss was -6.7% when I grabbed this table. In the context of the massive longer-term returns, it’s not a big deal whatsoever, but it’s notable in 2025 nonetheless. Crude oil continues to be the eyesore at the bottom of the list and -19% on the year while continuing in rather persistent short, intermediate and long-term downtrends. Bonds too, have not captured any serious interest and have suffered relatively for many years. While central banks are intent on convincing the populace that rates are coming down (governments sure would like to contain their borrowing costs), the long-term yields at 5-10+ years out still look to be rising, globally. This isn’t a local phenomenon. Interest rates bottomed BIG-TIME in 2020 and what happened (rates went to zero or even below zero!) happened, it’s behind us. If you’re still one of the Canadians hoping to see a 5-year term mortgage renew at sub 2% levels in the year or two ahead, I suggest you forget about it and accept the bubble that it was (in the past).

Source: Optuma

* as at December 29th, 2025

2026: What Lays Ahead? - [by David Cox]

Most of you know I’m not a fan of making forecasts and/or establishing price targets to gauge expectations and/or dictate our strategy. That said, there are always things underway, and potentially about to get underway, that could have significant ramifications for investors, consumers and citizens all the like! While some of the ideas are perhaps controversial, you know I’m not afraid to take a stance different than the herd as I’d rather focus on reality (i.e., underlying market forces of supply & demand) vs. the supposed reality that they tell us has to be because of X, or Y, or Z…

What do I think could happen and be of potential importance in 2026?

- Long-term, global yields not only stay stubbornly high, but they rise further

- Commodities & related commodity stocks move higher and re-stoke inflation concerns

- The supposed benefits of central bank digital currencies are further espoused as government grapple with maintaining an illusion of confidence

- Canada’s housing market deteriorates more rapidly as default rates rise putting lenders on watch…

- After posting a negative 1-year return for Bitcoin in ‘25, Bitcoin’s long-term trend re-emerges as it makes new all-time highs in ’26…

- The BRICs countries continue to increase momentum as they shed U.S. dollar/treasury exposure in favour of gold and/or other assets

- Asian & emerging markets post the strongest returns for stock investors

AllINsync: How Are We Exposed? [by David Cox]

One clear trend in 2025 has to be towards an increasing amount of non-U.S. equities. U.S. equities, which have largely dominated vs. all other equities (around the world) for a long time (i.e., 10+ years) have slowed this year, relatively, as other markets rise both absolutely and relatively and play catch up. As I discussed further above, in the “What Are We Buying? Selling? Holding…” column, Canadian equities have been appearing, in more broad form, as the year has developed. There are also an increasing number of foreign equity stocks that are rising and many markets (i.e., Europe) have large financial/bank weightings in their indices, which have added strength…

Here's our geographic positioning in our #AllINsync (RJI237) fund as we close out the year: Canadian equities ~+37%, U.S. equities ~+36.7% and foreign equity ~+10.8%.

#AllINsync (December 30th, 2025)

Source: Optuma

* as at December 30th, 2025

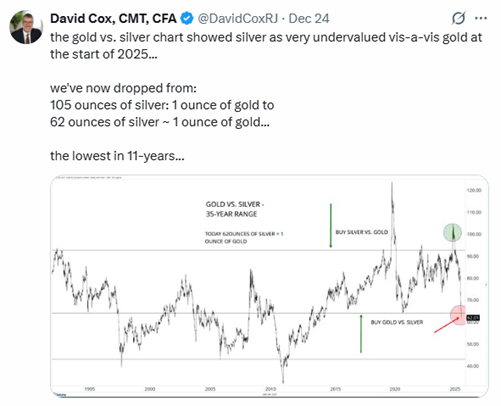

Chart of the Month - [by David Cox]

Silver has had a very strong rally, and I admit it didn’t seem surprising to read of rumours surrounding an institution and/or bank that is collapsing as silver surges as they sit (sat) short of the rally. An investor who sells an asset short is selling something that they do not own, expecting (hoping) that it will fall in price so that they can later re-buy the asset at lower levels and profit (and return it to whom they borrowed it from). But shorting assets, or stocks, that are exploding in price amidst strong uptrends isn’t for the faint of heart (the opposite of course is buying the stocks that are plummeting, also not a practice I’d encourage). Either way, “why” is silver rising?

The media typically arrives with the reason after the price moves and this is perfectly normal narrative behaviour. You’ll read of structural supply deficits, and exploding industrial demand from solar panels and EV cars, data centres and AI and you’ll also see references to safe-haven and investment demand, or silver playing catch up to gold and of course geopolitical and policy risks. But if we’re honest, and critical, we can throw these same narratives against other price moves (both up and down), though not nearly so (recently) substantial.

But so what… big rally and in the past week, as we close out 2025, the rally has some capitulation type characteristics that includes rather wild outside “biggest bar against” reversal bar on December 29th, when prices hit highs and then subsequently crashed -13-14% from those intraday highs. Certainly could be capitulatory buying from those short-sellers as they meet a margin call and their financial position collapses. Maybe we’ll read more about this in the new year.

Source: Optuma

* as at December 29th, 2025

Social Media and Our Website - [by David Cox]

Do you follow me on “X” (formerly Twitter)? I can be spotted @DavidCoxRJ and regularly post charts and market context if you’re interested! You might even spot our team on YouTube in 2026 as we potentially develop a channel focused on investment education and debunking investment myths that are pitched regularly by the media as gospel.

Here are a few recent posts that got some attention:

Upcoming Dates, Seminars, and Announcements - [by David Cox]

What: “CNBC Arabia”

Where: www.cnbcarabia.com

When: January 7th, 2026

Who: I’ve been invited on to their show again early in the new year, though it’s in Arabic and not too easy to hear my comments for all of you English speakers!

What: “Investing with IBD Podcast”

Where: www.investors.com

When: January 14th, 2026

Who: I look forward to joining host Justin Neilsen again for an upcoming episode!

What: “CMT Fill the Gap Podcast”

Where: https://cmtassociation.org/education/podcasts/

When: May 6th, 2026

Who: I’m very excited to join fellow CMT charterholders David Lundgren and Tyler Wood and have an opportunity to discuss my investment philosophy, decision-making tools and share lessons my own history book!

What: “CMT Proshares Education Event”

Where: TBD

When: May 20th, 2026

Who: I’ll be sharing the stage and providing investment insights and education as part of the conference.

Happy New Year to you and your families! I sincerely hope you’ve found something interesting or worthwhile as you’ve read through our “Quarterly INsync Chit Chat” and as always, please don’t hesitate to provide us with your feedback (good or bad!), and we thank you in advance!

Sincerely,

David Cox, CFA, CMT, FMA, FCSI, BMath

Senior Portfolio Manager, Wealth Advisor

Raymond James Ltd.

Phone: 519.883.6031

Unit 1 – 595 Parkside Drive | Waterloo, ON | N2L 0C7

david.cox@raymondjames.ca

www.financiallyinsync.com

@DavidCoxRJ

@DavidCoxRJ

Disclaimer: Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Financially INsync Team, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Statistics, factual data and other information are from sources believed to be reliable, but accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James Ltd. is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities.

Raymond James Ltd. is a Member Canadian Investor Protection Fund.

Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd., member FINRA/SIPC.