Are We In A Bubble? Absolutely!

From time to time, the media actively cultivates narratives for us and with social media, the ability for headlines to be tossed about only increases. What is a bubble? A bubble isn’t just about the prices of assets that have gone up too far, or perhaps too quickly. A bubble is more about overinflated expectations that eventually, when reality sets in, pricks the bubble leaving many to wonder how it all happened as prices fall (sometimes precipitously). How many times have you seen your government tell you that inflation is “lower” and/or “coming back down”? And yet, prices are higher. Of course they are, because inflation is inflation and it’s a growth rate on those prices. A lower growth rate is still higher prices. Yet many somehow want to believe what they’re saying.

I think we are in a bubble, but it’s not the bubble you’re assuming that I’m referring to. I don’t mean stocks, gold, silver or bitcoin. When I was pointing out in 2018 and 2019 that bonds were in a bubble (and telling our risk/compliance folks that it wasn’t wise to label said bonds as “low” risk (I encouraged high), they told me no. But here we are, almost six years later, after that bubble burst in 2020 – and for the record, few were willing to say it was a bubble and now, in the aftermath of the move higher in interest rates (globally), many are wishing for the bubble to return (still oblivious to the fact that interest rates going to zero or even below zero in some parts of the world (!!!) was utterly nonsensical (i.e., a bubble!). Those of you saddled with debt or with mortgages to roll over need to come to grips with the fact that the interest rate bubble has sailed. What is the real bubble in today’s markets isn’t the assets that have been rising, but instead, I think it’s in the blind faith that the system won’t quietly continue to take from us…

I think we’re living in a bubble whereby many trust that the governments have our backs and our best interests at heart and we (mistakenly) believe that the money we all work hard to earn, save, grow and protect simply isn’t worth what it was yesterday, or last year and next year it will be worth even less. It’s not about an exchange rate vs. another currency, it’s about fiat currency (government-issued money not backed by anything, instead deriving value from trust in the issuing government) and the non-stop loss or purchasing power that we all experience.

The Theft We Ignore

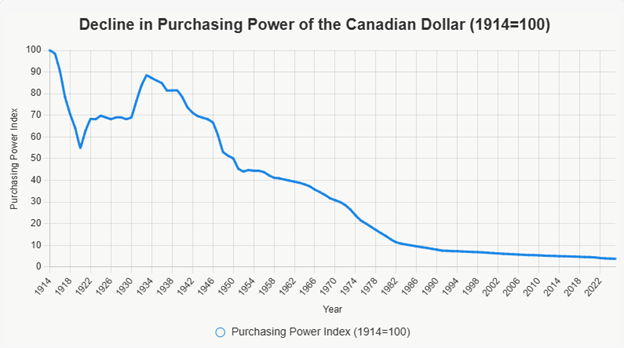

Here's the ugly downtrend in purchase power affecting Canadians (the chart is the same inmany other currencies!) that shows that we’ve lost ~95%+ of the value of the money we’re told to trust. Houston?

Source: Statistics Canada, inflationcalculator.ca

It’s Time That We Wake Up

This inflationary scheme is manufactured as you may realize, and it’s done by central banks and governments through the growth in the money supply which causes inflation. Inflation is like a hidden tax (quite visible for those that pay attention) and frankly, it’s theft. For a government to encourage citizens to work hard only to face tax burdens (the top marginal tax rate in Ontario is 53.5%!) and then find that what they’re left with buys less and less as time goes by is a problem.

Years ago, in 1933, the U.S. government made it illegal to hold physical gold. That’s right, anyone owning it was forced to turn it in (note: those that didn’t, benefited from the repricing that it experienced thereafter). In 1971 though, things changed materially (and the bubble began) when the U.S. government defaulted on its debt and declared that no longer would its U.S. dollars be freely exchangeable for gold (they were backed by gold at the time). It was too easy to manufacture too many dollars, which allowed for uncontrolled spending and in the past 50+ years since? How many even remember (or know) that paper money used to be backed by something? I suspect only very few. It sure would be nice for all of us holding/earning/saving paper money for it to be backed by something tangible.

Remember when Tiff Macklem, Governor of the Bank of Canada, stated (July 15th, 2020) that “interest rates are very low and they are going to be there for a long time”? Oops. Please, I urge you reader, to quit thinking it’s the central bank that controls the interest rates/yields – and realize it’s the bond market (outside market forces) that controls them. That’s why it was a bubble. As credit risk increases (you’ve seen the soaring debt numbers, right?), clearly anyone investing in government debt can realize the risk of being paid back is suspect, though the smarter acknowledgement is that they’re promising to pay you back in dollars that are worth so much less in the future. They’re taking advantage of us. Did you notice that the Bank of Canada is now re-evaluating (again) its inflationary formula to consider removing the higher cost of mortgage interest rates that most home buyers in this country are subject to? It’s a gimmick. Expect more.

It’s time to inventory your trust and to realize that to avoid losing the trust of the masses too easily, inflation is their weapon and that battle raises prices further, the prices of the goods we consume and the prices of inflationary assets like stocks, gold/silver and bitcoin. Good for those who have, brutally challenging for those without assets and yet trying to get started.

Sincerely,

David Cox, CFA, CMT, FMA, FCSI, BMath

Senior Portfolio Manager, Wealth Advisor

Raymond James Ltd.

Phone: 519.883.6031

Unit 1 – 595 Parkside Drive | Waterloo, ON | N2L 0C7

www.financiallyinsync.com

@DavidCoxRJ

@DavidCoxRJ

Source: https://www.bankofcanada.ca/2025/10/underlying-inflation-separating-signalfrom-noise/