Quarterly Strategic Review - 4th Quarter (Oct - Dec, 2025)

Fourth Quarter 2025 – January, 2026 – It’s Getting Stronger…

I’d forgive you for thinking that as we all sit here in 2026, the stock markets that are entering their fourth year of the ongoing bull market, surely must be due to peak, right? If I’m being honest (and objective), the stock markets are actually getting stronger, not weaker. In 2021 (after a strong 2020), market breadth deteriorated as stocks continued to rise on the fumes of the biggest few, the “MAG 7”. That’s not the case today.

I think it’s fair to say that markets are increasingly open-minded to the devaluation trade, meaning that central banks are losing control of the very punchbowl that they control. Our purchasing power has been significantly weakened since the massive money printing in 2020 in response to COVID and without a doubt, the BRICs countries (Brazil, Russia, India, China, South Africa +++) are getting stronger as a whole, and choosing to diversify their own assets and financial futures beyond the standard role of the “U.S. dollar”.

It also seems necessary to mention that while I write this each quarter in the context of the recent quarter-end, we’ve already seen a very strong start to 2026 thus far. Our #AllINsync (RJI237) pool has a NAV of $12.084/unit as at January 13th, 2026, which is up from $11.186/unit at the end of the year!

We Must Avoid Our Own Biases

As investors, I mean as people, we all have biases. We think that we know all there is to know about this or that, but in reality, our own biases can cause us to miss what changes before us. I’ve been finding more than a few times in recent years that rules of thumb that I “know” to be true, are old and out-dated and not even accurate. It is refreshing (only because I’m open minded to it) to have the younger generation, especially here at Financially INsync, tell me I’m in need of re- calibration (honestly, I’m trying to encourage Avery & Kieran to always question things and not be afraid to not just accept what they hear, or see it as being the way) because I know full well that without an open mind, and a willingness to accept that we do not and CANNOT understand everything, we will fail as investors, and more importantly as humans, family members and friends. We have to be able to speak the truth to one another and when someone questions our own thinking, or calls out our own shortfalls or misgivings, I can only pray for enough humility and a quiet heart to listen and actually hear them.

The Headlines Were Negative and The Markets Responded (Positively)

Last spring, as the markets were grappling with the perceived risks of the new tariff wars, the falling productivity and economic might (per person) in Canada, the stock markets broke out and moved higher (and they haven’t stopped since). For many years, all of us (as clients) were underweight Canadian stocks, which spent the better part of 14 years underperforming the U.S. market. And pretty much ditto for the foreign markets, whether we’re talking Asia, Europe or the emerging markets. Do any of you even remember the incredible (absolute & relative) strength of Canada, commodities and the emerging markets +/-20 years ago? It was impressive but it didn’t last. But we never know as investors and just because something didn’t work for 14 years, doesn’t mean we shouldn’t be open-minded toward the possibility that those circumstances could re-emerge and we could miss it.

Canadian Dollar Bottomed, But?

In February, 2025 as the media was pitching scary tariff headlines that would crush Canada, the Canadian dollar bottomed (or so I said at the time), and it was a pure technical view through the lens that when markets bottom in the face of supposed bad news (or peak as the news is all rosy), it’s not uncommon. Price inflection happens when most aren’t expecting it. The herd tends to move together and group think is common, though dangerous, given its implied biases to us as investors.

It's one thing to bottom, it’s another thing to rise. Last year, in 2025, the Canadian dollar did rise ~+4.8% and this no doubt cost us in our portfolios. Every dollar (not quite, but I’m trying to make the point easier to understand) that is invested in U.S. stocks weakens as the Canadian dollar rose, when translated back into our own native currency. It was a headwind, though at times it operates as a tailwind. Either way, as we sit here early in 2026, the Canadian dollar is NOT going up (though it did bottom still in Feb ‘25)… given all that is happening, economically and with commodity prices, I do think it’s fair to suggest that it could indeed begin to rise, which would only further serve to benefit the so called “value” trade which includes Canada, commodities, emerging markets and so forth but we can’t get ahead of ourselves. I never want to forcefully position our assets by acting on narratives or thinking, without an open mind, knowing that what I think “could” happen, or even “will” happen will end up happening. In fact, it might even be the opposite. I accept that.

Gold, and particularly silver, have soared in value (when translated into the currency we’re all used to using) and again, we can say that demand has exceeded supply, or we can say that foreign governments are seeking a safe haven for their assets or they’re seeking diversification or there is inflation fear or there is concern about new wars and we can go on and on. But bullion prices are rising and that means we’ll continue to benefit from their trend and their diversification opportunities.

Last year, Bitcoin fell for the first time in several years. It fell -6.2% or so (which I really don’t see as a problem especially given the vast majority of you first acquired Bitcoin before we even left the bank, on November 30th, 2022. It’s up +397% since then and so we sit on our positions). The crypto-currency stocks and mining exposure we have through the $BITQ and $BITS also corrected (again) in 2025, but nothing has changed as I see it and we’ve done well over the recent years by ensuring we’re zoomed out enough to see and participate in the big picture. As I write this, it looks like the Bitcoin price is trying to resolve higher after pulling back after making all-time highs in October, 2025.

Source: Optuma

* as at January 12th, 2026

Our Strategy & Our Allocation

AllINsync (also known as RJI237) was down on the quarter, though entered 2026 with a burst of strength and just closed at a new high of $12.084/unit. Overall, I’ve been more than pleased with its implementation and while its inception date was immediately followed by a very tough set of market conditions, we’ve moved forward, we’ve re-oriented ourselves, we’ve tightened up our approach, we’ve embarked on a ton of new learning about options and are in the midst of a multi- year revision to our “Financially INsync Investing Playbook” that contains the rules, and methods of our process and position sizing methodologies.

I recently found out that I was wrong about the taxation of AllINsync and I suppose on the one hand, I should have realized why what I thought didn’t make sense, the truth is we’re all due to receive a T3 for our positions (in taxable accounts), which I did expect. And while those T3s are going to make tax filing a breeze compared to the past, it isn’t going to permit us to avoid paying some tax on capital gains that were realized inside the fund (in ’25 and in future years). I had many conversations with you over the past year and more, conveying the idea that a deferral would exist, long into the future, as if the fund itself could pay its own way (taxes), but in reality, this doesn’t make sense. If the pool had to pay taxes, and then you later paid them again, that would be double taxation and not in our interest.

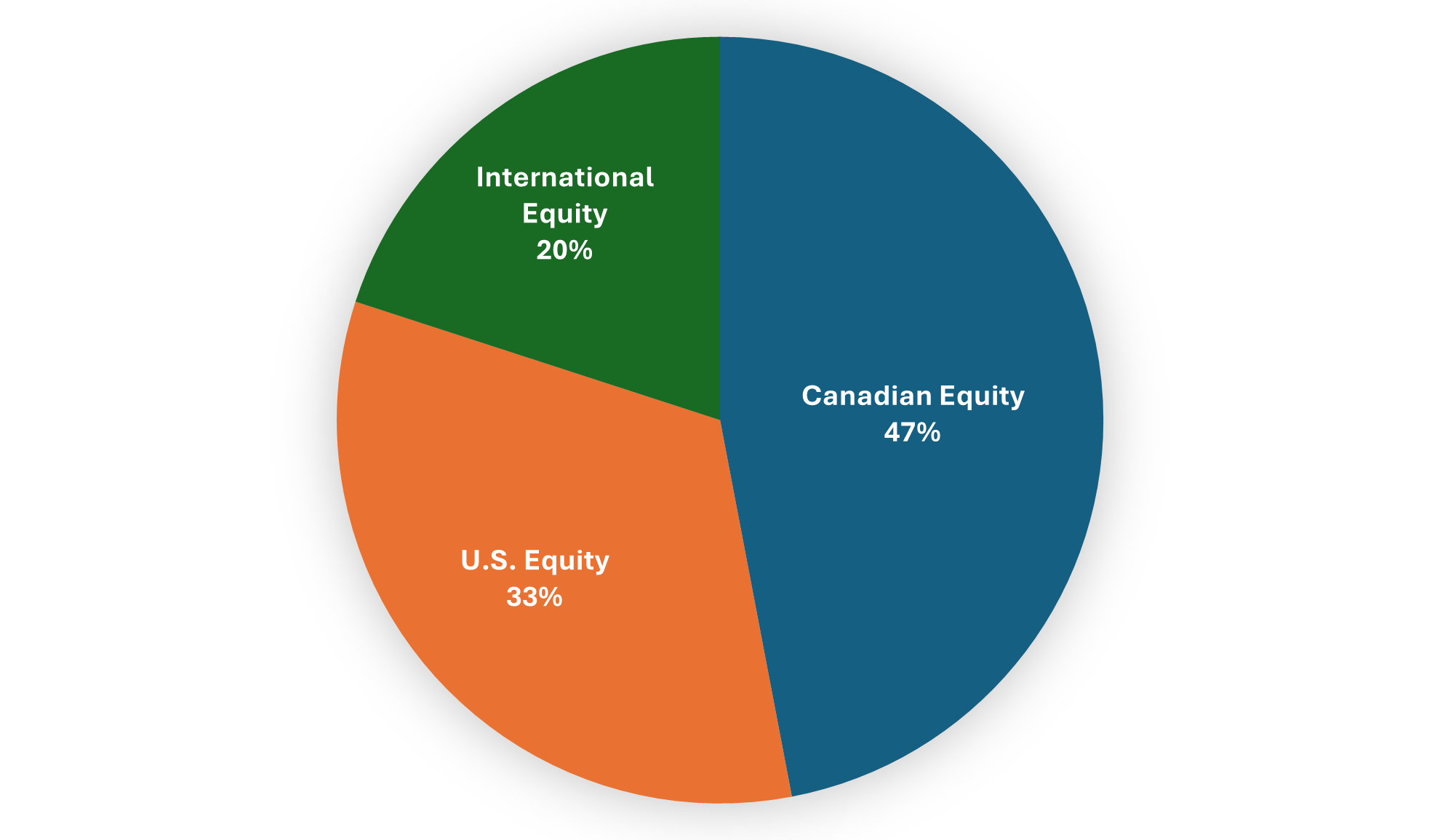

We have continued to move our exposure in AllINsync outside of the U.S. market and to diversify into not only more of own our Canadian equities, but also into non- North American markets. Geographically, here’s our current exposure (Jan 15th, 2026):

Source: Croesus/Excel

A Few Reminders & Closing Thoughts

It’s (almost) tax time! For some of us, it’s time to make new TFSA/RSP and RESP contributions! It’s always a busy time of year for us here at the office as the year begins in earnst and I wish you all a very Happy New Year as we seek fulfillment and prosperity in the year ahead.

For those of you that manage to keep interested in our investment strategy, I’ll encourage you to consider watching my recent appearance on “Investing with IBD” that happened on January 14th, 2026. Here’s the link: https://www.youtube.com/live/WGbAFFaarYE?si=3VTWx7H8PdDA8h7Z

If you didn’t see my recent blog post “The INsync Angle”, this too will help you understand and perhaps see a different perspective when we try to make sense of the world today and figure out if it’s a big bubble!? Here’s the link to our blog post!

Finally, and for the first time in what seems like many years, we’re going to run an in- person event on the top of “Living Is Giving” on March 25th, 2026 at 8:30am in Waterloo. The event will be recorded and will be available afterwards for those unable to attend. Many more details to come.

I hope you find this review helpful in some way and your feedback, questions and/or comments are always welcome!

Sincerely,

David Cox, CFA, CMT, FMA, FCSI, BMath

Senior Portfolio Manager, Wealth Advisor

Raymond James Ltd.

Phone: 519.883.6031

Unit 1 – 595 Parkside Drive | Waterloo, ON | N2L 0C7

www.financiallyinsync.com

@DavidCoxRJ

@DavidCoxRJ

Disclaimer: Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Financially INsync Team, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Statistics, factual data and other information are from sources believed to be reliable, but accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James Ltd. is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities.

Raymond James Ltd. is a Member Canadian Investor Protection Fund.

Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd., member FINRA/SIPC.